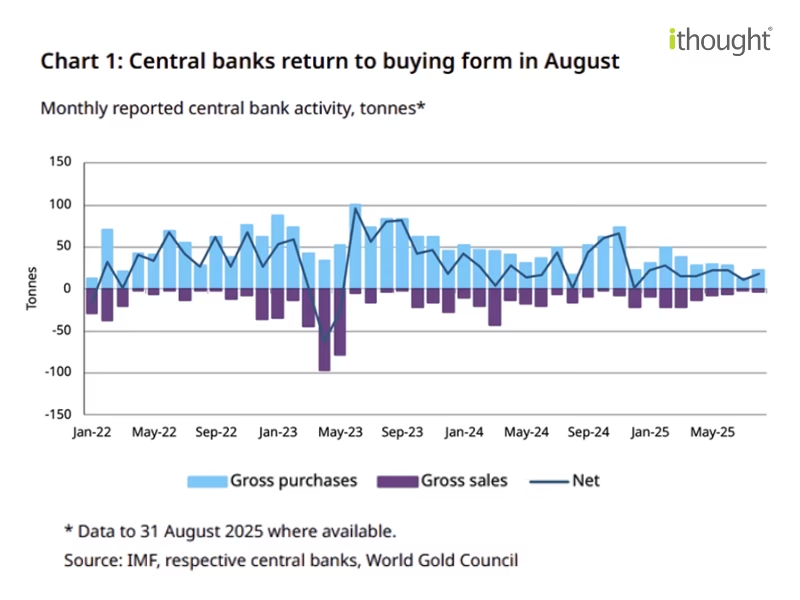

Let’s look at an interesting data point. Since 2022, Central Banks have bought upwards of a thousand tonne of gold every year! In the decade prior to that, the average demand from central banks was about 400-500 tonnes. So, how did demand double in such a short span and why are central banks obsessed with gold?

The top three reasons that have given central banks the conviction to buy gold are relating to financial security, inflation, and asset allocation.

Financial Security

To understand this gold buying spree, we need to rewind to the biggest event in 2022: Russia’s invasion of Ukraine. The US simply did not like what Russia did and tried to hit back hard. Instead of fighting this war on the ground, the US chose to do it through economic sanctions. It froze Russia’s dollar denominated assets.

This move was unprecedented. A lot of other countries felt the pinch. With dollar dominating global trade, most central banks held dollars or dollar denominated assets. Did this mean that any political or ideological misalignment from the US could lead to such harsh sanctions?

That’s not something any reserve bank wanted to leave up to fate. To avoid being arm twisted in negotiations, central banks turned to a failsafe universally accepted currency: gold. Shoring up gold reserves allowed them to trade with partners across the globe and de-risked their dollar exposure.

Inflation

Gold is a difficult asset to value. After all, it’s not widely used by industries and it’s use is limited to ornaments. It’s not an asset that generates cash flows or creates value through other means. In fact, after the gold standard was abolished in the 1970s, it hasn’t even backed a major currency.

But gold is special. It’s an asset that is valued relative to other assets. So, you could measure gold by the equivalent number of units of equity index, grams of silver, square feet of property, etc. Gold has the power to retain its purchasing power. While currencies depreciate over time, gold does not.

In the post-pandemic world, advance economies have been combatting inflation. There are several contributing factors to the world’s inflation problem. This includes logistical bottlenecks, tariffs and trade wars, supply disruptions, inadequate supply, and currency depreciation.

Asset Allocation

Lastly, central banks also benefit from diversification. Gold is a low correlation asset that does better when interest rates are lower. With global growth taking a hit and inflation remaining elevated, gold is the perfect hedge. Gold also protects portfolios from local macroeconomic risks as well as dollar risk. The dollar has had an unusual depreciating trend this year with the DXY losing close to 9% since January. While currency movements are hard to predict, central banks can prepare for uncertainty with allocations to gold.

Where Is Gold Heading?

Gold has been a strong performer in 2025 – touching new all time highs multiple times this year. It currently trades close to $ 4,000 / oz and has delivered close to 50% returns in 2025. Central banks allocation to gold is a function of their need to manage risk effectively, protect their purchasing power, and to hedge against geopolitical risks. As far as gold is concerned, it’s a strategic choice in a central bank portfolio.

The pace of buying has slowed down in 2025, with central banks lapping up close to 600 tonnes in the first three quarters of 2025. Are we seeing a mean reversion in this trend or could gold be heading into a new era?