After years of rising tides lifting most boats, investors now face a fundamentally different landscape—one where selectivity, not market beta, will determine investment success.

The Indian equity markets experienced an unprecedented rally following the COVID-19 crash of March 2020. This rally was characterized by its broad-based nature—virtually all sectors participated in the upward movement, driven by massive liquidity injections, policy support, and a synchronized global recovery.

This was a period where portfolio construction was relatively straightforward buying the index or maintaining broad sectoral exposure delivered satisfactory returns.

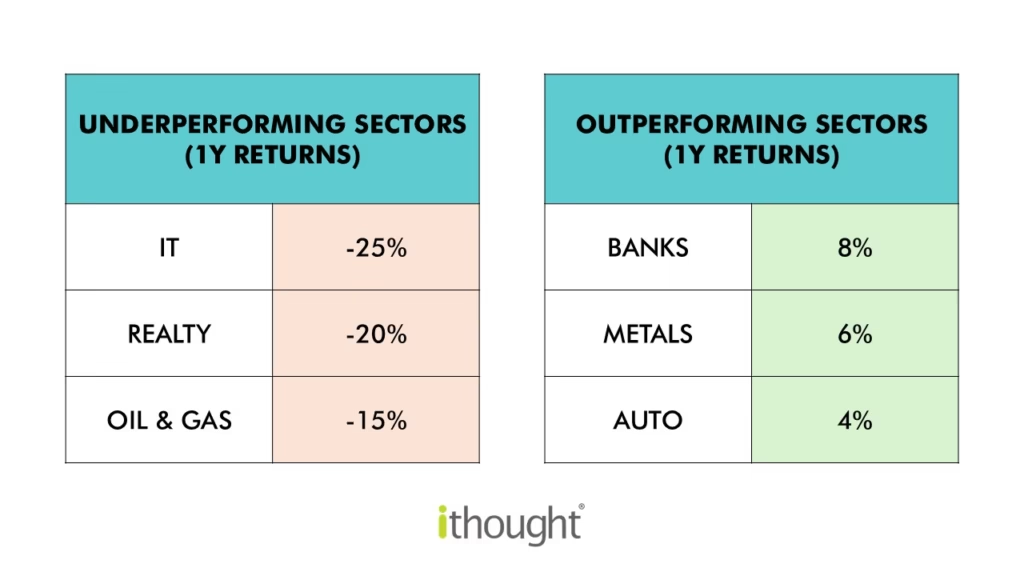

However, the one-year performance data tells a starkly different story, signalling the end of this broad-based rally era. The current market landscape shows significant dispersion in sector performance, with winners and losers clearly separated:

Even the benchmark indices reflect this challenging environment, with NIFTY managing just 0.5% returns over the past year while the Sensex posted negative returns of -1%.

Corporate Earnings: The Underlying Story

The shift from broad-based gains to selective performance is fundamentally driven by corporate earnings trends. The EBITDA growth distribution data reveals a concerning deterioration in earnings quality across the BSE 500 universe:

- Companies reporting EBITDA growth above 15% declined from 255 in Q2’24 to 170 in Q1’26

- Simultaneously, companies with EBITDA decline greater than 5% increased from 73 to 116 over the same period

- The proportion of high-growth companies has compressed from 51% to 34% of the BSE 500

This earnings polarization means that while a shrinking pool of companies continues to deliver strong growth, an increasing number are struggling with declining profitability. The days when most companies benefited from the post-COVID recovery tailwinds are clearly behind us.

Unlike the post-COVID period when synchronized global stimulus supported all risk assets, the current environment features varied regional growth patterns, inflation concerns, and divergent monetary policies.

Investment Strategy for the New Era

For investors, this new reality demands a more sophisticated approach—one that prioritizes quality, emphasizes active stock selection over passive indexing, and recognizes that not all sectors or companies will participate equally in future market gains.

The rising tide that lifted all boats has receded, and success will now depend on choosing the right vessels for the journey ahead.