When it comes to investing, we’re all faced with a myriad of choices – real estate, fixed deposits, mutual funds, direct equity, and advice from various sources like friends, relatives, colleagues, and social media financial influencers. Lately, there’s been a buzz about index funds, but is it really the one-stop solution for building wealth?

Diving into the World of Equity

India has been on a journey, exploring domestic Indian equities and stepping away from traditional assets. Investing in direct equity demands time and a deep understanding of business fundamentals and industry macroeconomics. However, not everyone has the luxury of time or expertise to navigate the complex world of stocks. Mutual funds, with their fund managers and research teams, provide an accessible entry point into the equity game, albeit at a higher cost.

The Temptation of Index Investing

Now, let’s talk about the rising star – Exchange Traded Funds (ETFs) or Index funds. These funds follow a benchmark without the need for a dedicated manager, keeping operational costs to a minimum. Their popularity stems from lower costs and the belief that active fund managers often struggle to outperform their benchmarks.

The Allure of Lower Costs and Minimal Bias

Choosing index funds seems like a no-brainer with their lower costs, absence of active fund manager bias, and close regulatory scrutiny. Index values are crucial market indicators, making them seem safer than their active counterparts.

The Truths of Romancing The Index

Peeling Back the Layers of Index Romance

However, beneath the surface, the reality is a bit more complicated. The underlying securities in equity indices are volatile and prone to correction, not too different from actively managed funds. Despite the lower costs, the significance can get lost amid market volatility. For instance, the daily movement of an index (0.5% – 0.6% on average over 220 trading days in a year) might save an investor around 1% in a year – a modest benefit considering the market fluctuations.

Understanding the Risks of Index Composition

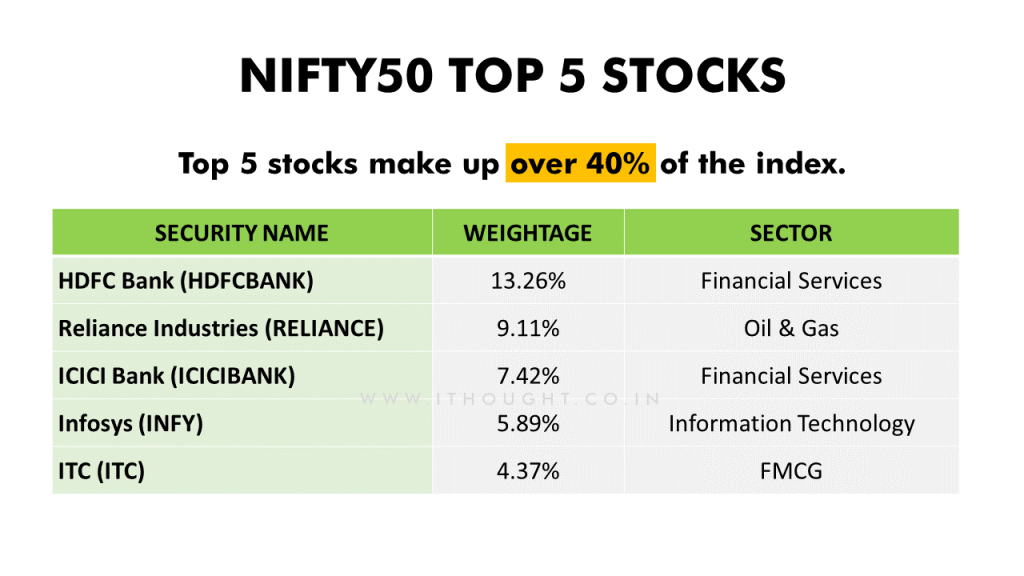

A knowledgeable investor may understand the above risk and may be prepared to handle the volatility of index funds. But another often overlooked risk is the composition of the index. Index funds heavily depend on a few components with higher weightages, leading to a concentration of performance on a handful of securities. The top 5 stocks in the NIFTY 50, for instance, make up over 40% of the index.

For want of space, it is difficult for us to carry the bottom 39 stocks out of 50 that carry the same 40% weightage. Among the 39, 24 stocks have lower than 1% weightage. You can see that the burden of performance falls on the very few securities at the top while a majority within the index could hardly move the index.

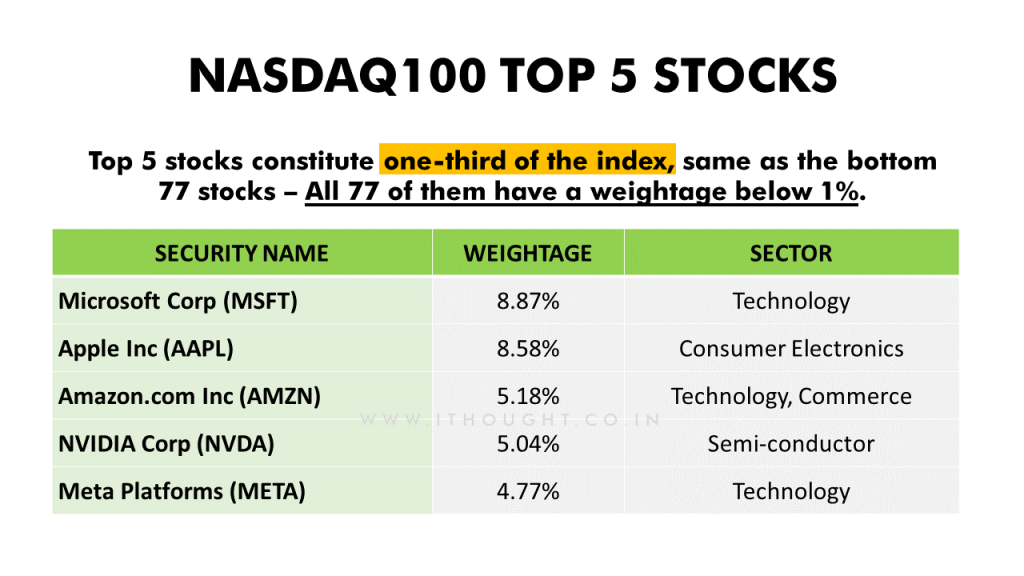

Let’s look at the Nasdaq 100:

There is no denying that there have been phases in the past when the index did phenomenally well and made it very difficult for active fund managers to better it. This essentially means that the few stocks at the top have done well. Index funds also peak in their popularity around this time. However, what follows is a long period of average performance in which active fund managers were able to perform significantly better. This is not a cycle but the active funds have outperformed significantly in the longer term except for very short periods.

Balancing Act: Index Funds vs Active Funds

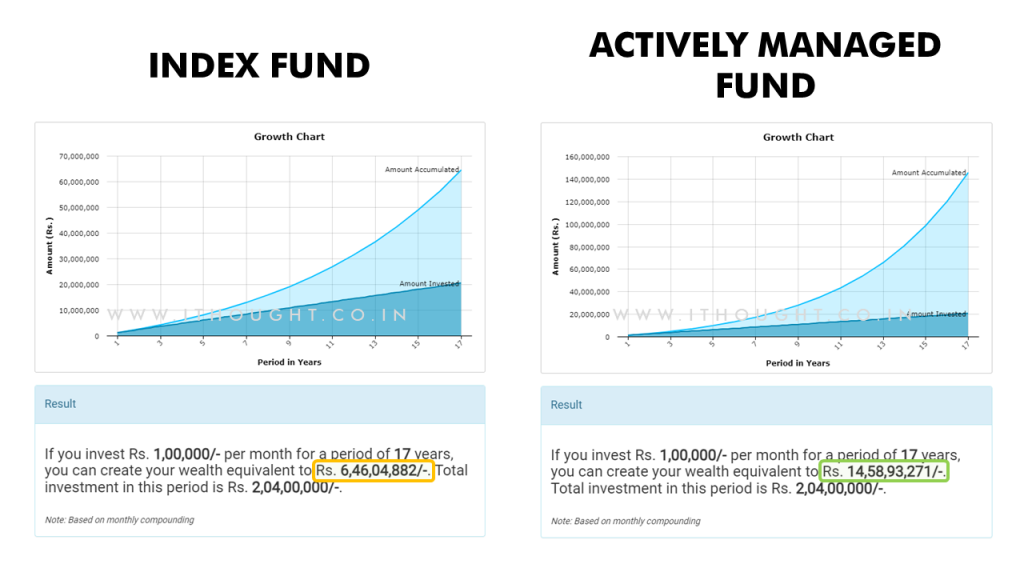

While there are phases when index funds outperform, history reveals that active funds tend to fare better in the longer term. A comparison between a SIP in an Index Fund and an Actively Managed Fund from January 2007 to January 2024 highlights significantly higher returns for the actively managed fund.

Note: Calculated using an online SIP calculator; for illustrative purposes only.

A Call for Prudent Investing

In the Indian landscape, Provident fund contributions and DIY investors are contributing to the surge in Index AUM. The Employees’ Provident Fund Organisation has invested Rs 27,105 crore in exchange-traded funds between April and October of this fiscal, which is about 51% of its investments in the instrument in the whole of last fiscal. In all, the EPFO has invested Rs 2.55 lakh crore in ETFs between 2016-17 and October 31, 2023. The well-informed DIY investor may prefer Index funds over active funds when the latter fails to perform, as a justification for the fee charged. But before you dive headfirst into index funds, here’s a word of caution. Despite the seeming simplicity of investing in index funds, it comes with considerations.

Index funds undergo restructuring twice a year, normally with no changes/restructuring in between. Active fund managers, on the other hand, have more flexibility and can take advantage of the rise and fall of the market at any given point in time based on opportunity.

Additionally, in investing, it is crucial to have a sound asset allocation strategy. Even if you were invested in a fund that was performing well, you must stick to a certain %weight. Sticking to a sound asset mix will help mitigate unnecessary concentration risk. Diversification across various funds or stocks is key to mitigating concentrated risk.

A Balanced Approach to Investing

In conclusion, while index funds have their merits, they might not be the silver bullet for everyone. “Don’t put all your eggs in one basket” holds true for investments. A balanced portfolio evaluation at regular intervals is essential for long-term investors. Seek professional advice, just as you would in other important aspects of life. Your hard-earned money deserves an investment strategy that goes beyond the index hype and aligns with your long-term objectives effectively, considering inflation.