The National Stock Exchange (NSE) announced changes to the Nifty 50 index on August 22, 2025. Effective September 30th 2025, InterGlobe Aviation (IndiGo) and Max Healthcare Institute will replace Hero MotoCorp and IndusInd Bank.

But does this reshuffling always benefit passive investors? Do such changes have a positive impact on passive investing?

Since it began in 1995, the Nifty 50 has changed a lot. Only 11 companies from the original list remain. Some of the constants include Reliance Industries, HDFC Bank, and ITC. Over time, the index has delivered strong returns, including a 28% annual growth rate from April 2020 to August 2024 after COVID.

Over the last three years, stocks that were added into the index have been characterized by very expensive valuations. At the time of addition, the newly included stocks were trading at:

- Zomato: PE of 286.92 – reflecting high growth expectations in food delivery

- Jio Financial Services: PE of 123.42 – premium for fintech potential

- Trent: PE of 118.79 – retail expansion story despite recent correction

- Max Healthcare: PE of 99.36 – healthcare sector premium [upcoming addition]

- Bharat Electronics: PE of 48.86 – rerating on defence sector growth

- InterGlobe Aviation: PE of 33.37 – aviation recovery story [upcoming addition]

- Shriram Finance: PB of 2.5x – fairly valued in the NBFC space

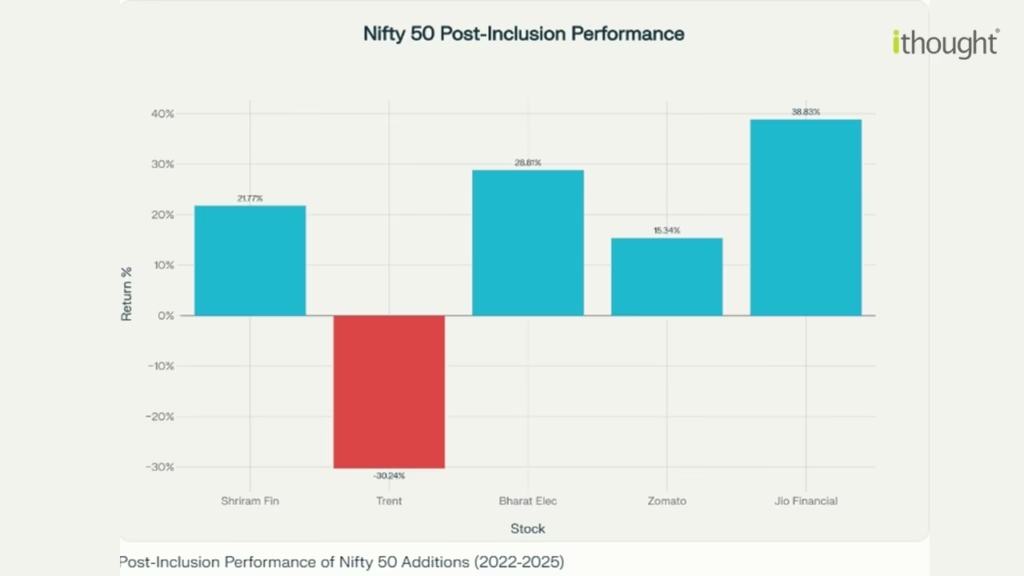

It’s worth noting that new stocks added to the index have had mixed results. Often, they do not perform well right after being included, but if their fundamentals are strong, they can do better over time.

So, does this have a positive impact on the Index?

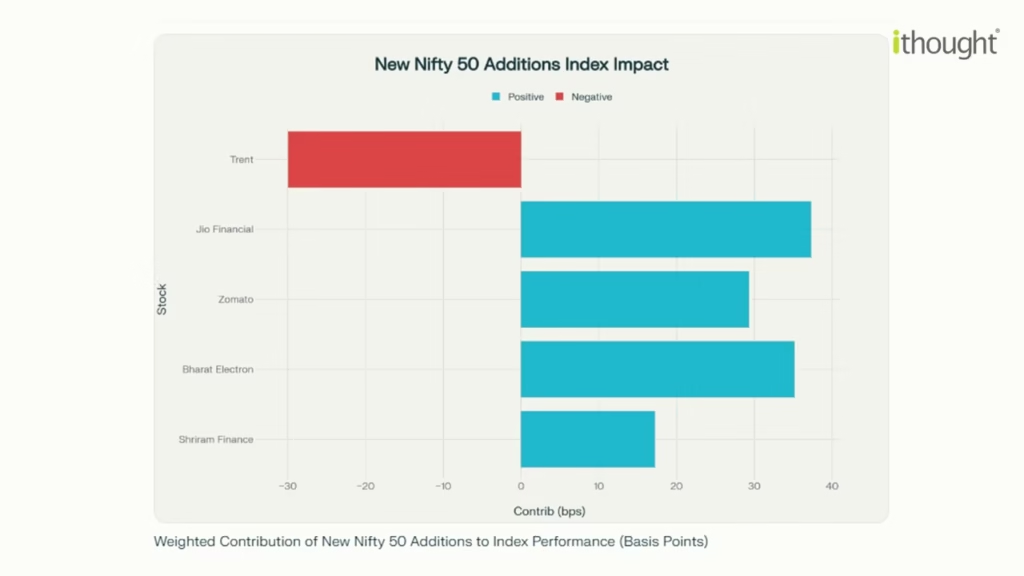

If you check the weighted average contribution of these stocks, you’ll see the number is quite small. Their total net contribution is just 88.99 basis points.

From March 2024 to August 2025, the Nifty 50 has delivered:

- Total Return: 10.15%

- Annualized Return: 10.25%

- Period Performance: 362 trading days across major inclusion cycles

The performance was uneven across periods:

- Mar 2024 – Sep 2024: +15.60% (strong pre-addition performance)

- Sep 2024 – Mar 2025: -9.28% (correction phase post-Trent/BEL inclusion)

- Mar 2025 – Aug 2025: +5.03% (recovery with Zomato/Jio Financial additions)

What This Actually Means:

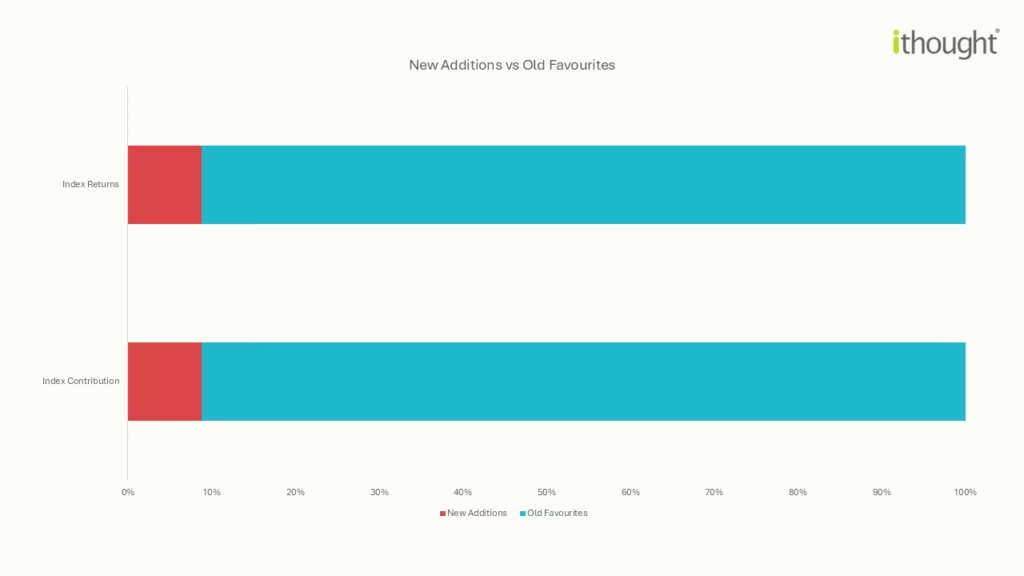

- 8.8% of the total return– This means that out of Nifty 50’s 10.15% gain, the new additions were responsible for 89 basis points or 0.89 percentage points of that gain. This is less than 1 percentage point.

- In absolute terms: The new additions added+0.89 percentage points to the index’s performance. Without them, Nifty would have returned approximately 9.26% instead of 10.15%.

- Relative contribution: The 8.8% figure represents how much of the index’s total movement can be attributed to these new stocks.

The new additions performed roughly in line with their weight in the index – not dramatically over or underperforming.

Conclusion:

Many investors believe passive investing is the best way to grow wealth. While this approach has worked well in countries like the US, India still lacks the products and market depth needed for passive investing to take off. Still, having tactical approach of combining passive and active strategies has shown good results.

To know how to build a strong investment strategy dive into our webinar: https://shorturl.at/SoGWU

The upcoming September 2025 additions of IndiGo and Max Healthcare will provide further insights into how high-PE, growth-oriented stocks perform post-inclusion in the current market environment.

Note: This is for academic study only.