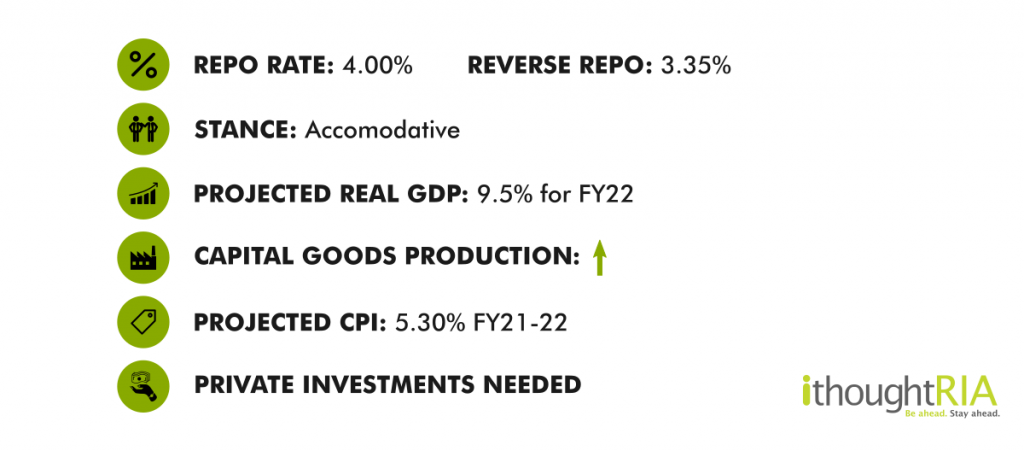

The Monetary Policy Committee of the RBI has unanimously voted to keep the rates unchanged at 4% and hold their accommodative stance by a vote of 5:1. This has been backed by GDP and Inflation being in line with their projections. GDP had expanded by 13.70% in the first half of this year. Activities in contact intensive industries have also been steadily improving in October. All components of the GDP registered growth. Real GDP grew at 8.40% YoY for Q2. The CPI stood at 4.5% for October 2021. Unseasonal rains led to vegetable price spikes. Fuel inflation stood at 14.30% in October. Real GDP growth projection for the year has been retained at 9.5%. CPI is projected at 5.3% for FY22. Inflation is expected to peak during Q4 and soften after.

The Governor also emphasized the fact that even as recovery is gaining traction, it is not strong enough to be self-sufficient, emphasizing the need for continued support. He called on the need for private investments, which have been lagging as they are essential to revive demand. On the consumption front, rural demand has held strong and urban demand seems to be strengthening. Capital goods production has remained above the pre-pandemic level for the third month running. GST collections and other broad-based indicators picked up in November. Downside risks include elevated commodity prices, volatility in global financial markets driven by monetary policy normalization in the west and continued supply chain bottlenecks.