In this blog we discuss…

-

-

- Introduction – Stock Market 2020

- The Calm Before the Storm

- In the Oven

- Wait, They’re Paying Me To Buy Oil?

- Pharma’s Saving Grace

- Printer Says

- Zoom Out For The Big Picture

- All That Glitters

- The Rust is Off

- Everybody Has a Coin

- Key Takeaways

-

Stock Market 2020

2020 was an eventful year in most aspects. Calling it an unprecedented year is putting it mildly. In this blog, we revisit 2020 from the viewpoint of equity markets. Crashes, unexpected winners and record-breaking performance. For a detailed review of the equity markets in 2020, read on. This is the journey from Meltdown to Madness.

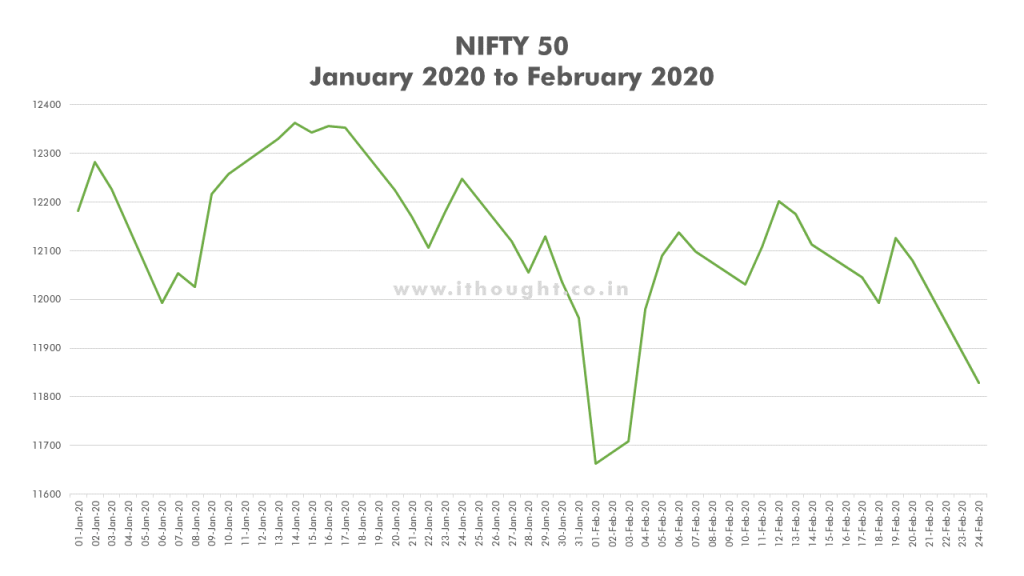

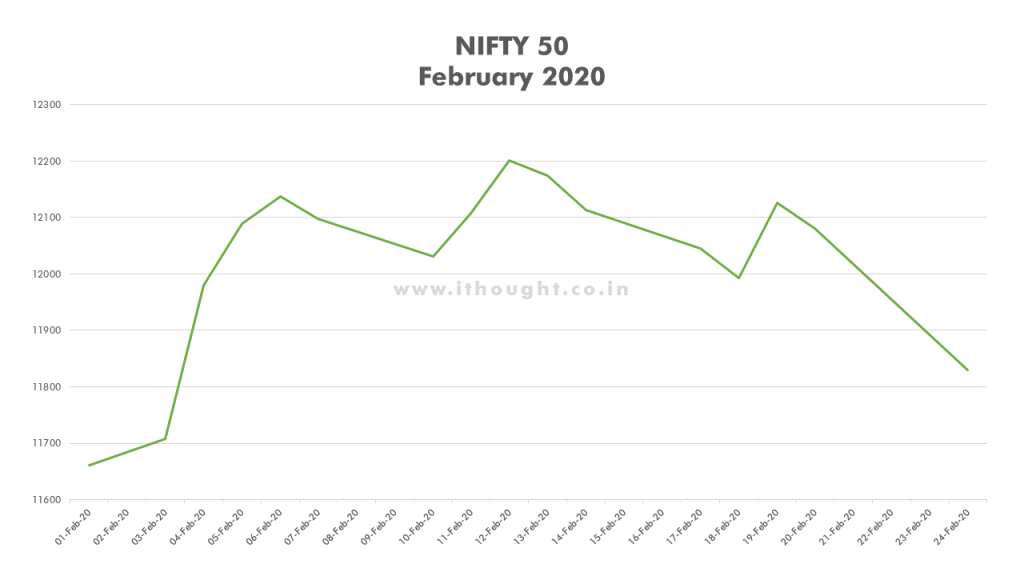

The Calm Before the Storm – COVID 19 & Stock Market

February was when the world started taking notice of the coronavirus. Apple shut retail stores in China, countries started issuing travel bans, and some closed their borders as well. An eerie uneasiness settled into global markets. Indian markets didn’t react violently although there was a fairly significant 5% swing from January 1st to February 24th.

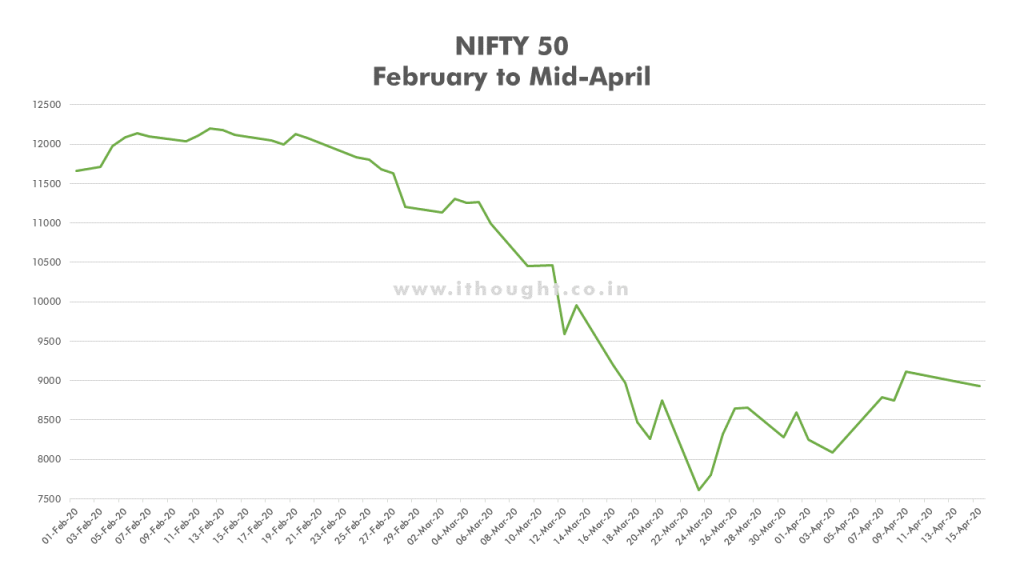

Out Of The Frying Pan, Into the Fire – Stock Market Crash 2020

March is when the COVID situation went from out of the frying pan, into the fire. Cases around the world started rising, countries started going into full lockdowns, and firms began cutting costs. Millions of people lost their jobs. In the US, the unemployment rate went from 4% in March to 14% in April, the highest since the great depression. As expected, markets reacted violently. All assets witnessed a sharp dip as investors clamoured for liquidity in the face of uncertainty. Cash was king. The Nasdaq saw a 29% fall and the Nifty saw a 37% fall by the end of March.

But that wasn’t even the most ‘You’ve got to be kidding me’ event of 2020.

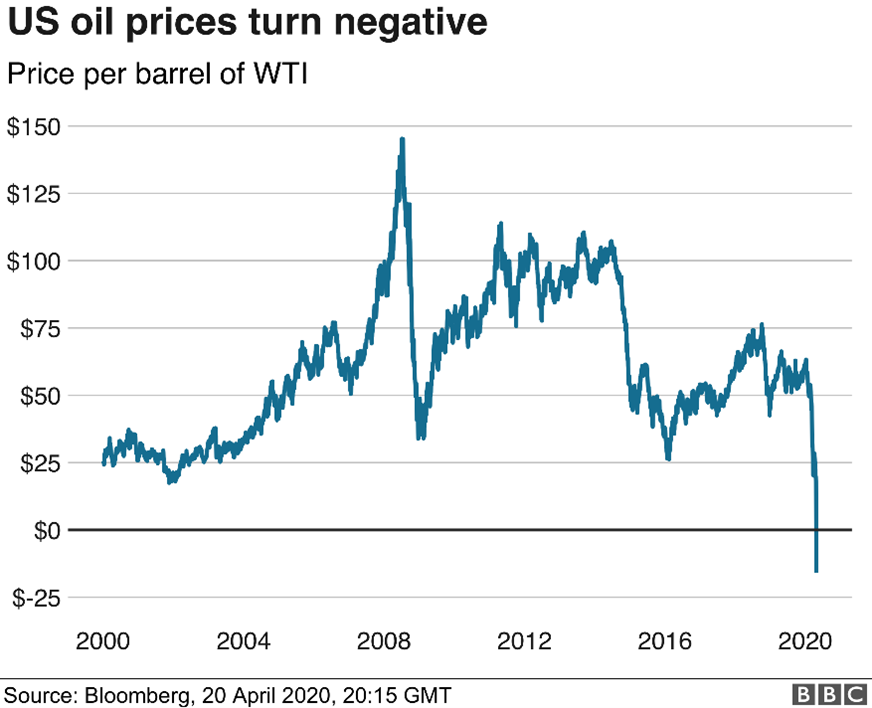

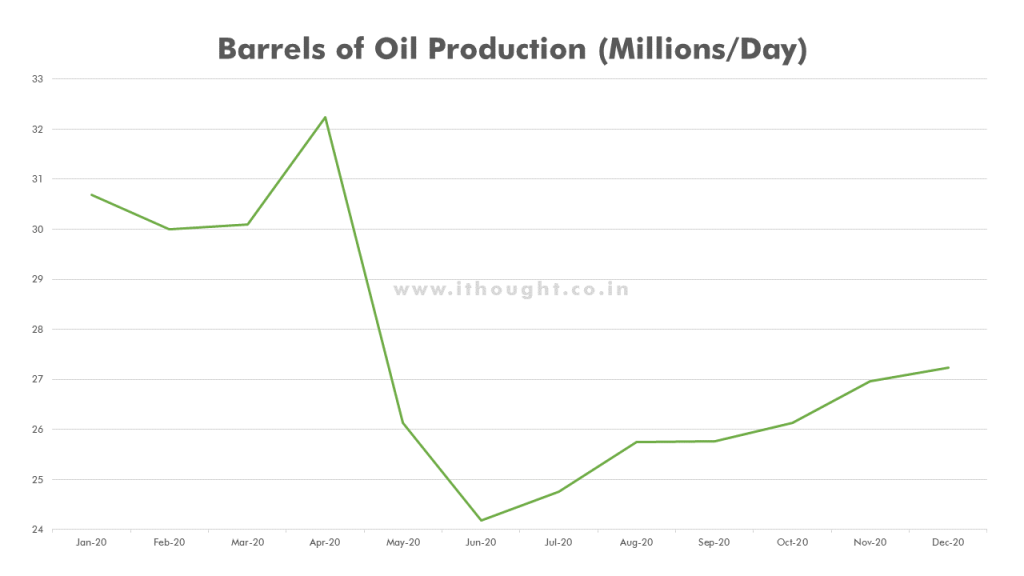

Wait, they are paying me to buy Oil?

With world trade coming to a standstill, the demand for oil dropped significantly. Nobody expected this though. On the 20th of April WTI crude dropped to a historic low of negative $37/barrel. The demand shock from the worldwide lockdown was so severe that oil producers paid buyers to take their stock out of fear that storage capacity would run out by May. This caused huge near-term swings in oil prices. It took until February 2021 for WTI crude to reach the pre-pandemic level of close to $60/barrel. OPEC adjusts the production (supply) of crude oil depending on the demand. It’s no surprise that they aggressively cut production which helped price recovery in late 2020 and early 2021.

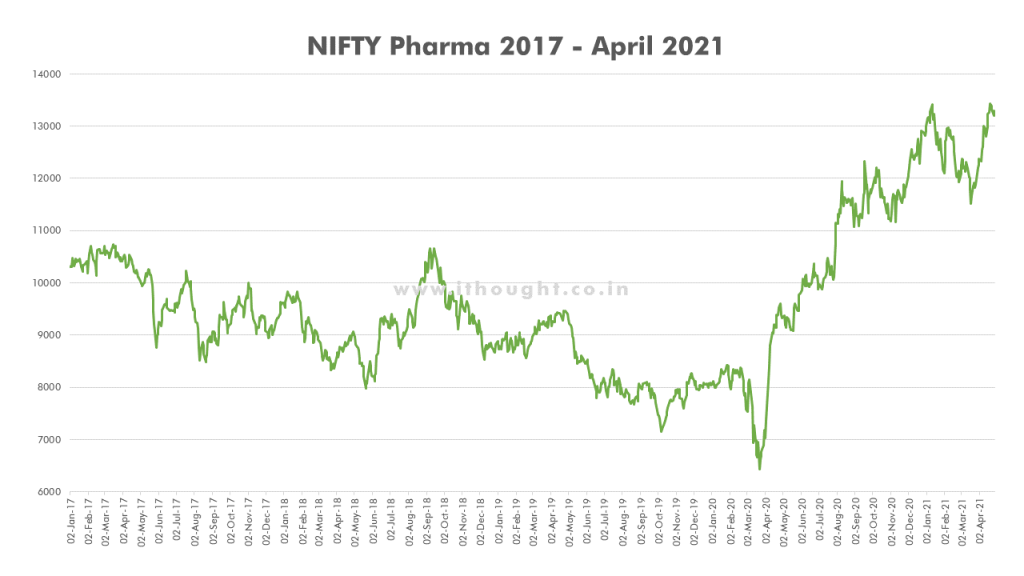

Pharma’s Saving Grace – Pharma Stocks in 2020

In a pandemic, pharma companies rose to the occasion. Covid-19 inspired a vaccine race akin to an arms race. This factor along with the desperate requirement for drugs and medical equipment saw the pharma sector do exceptionally well in the third and fourth quarters. Of course, the fact that the theme was one of the underperformers leading up to 2020 also helped its cause. As pharma gained solid momentum on its side, it became the flavour of the season.

The real question is – are we expecting too much? Will the pharma sector be able to deliver on the future earnings the market has priced in? Only time will tell.

Meanwhile, here’s a chart to ponder over.

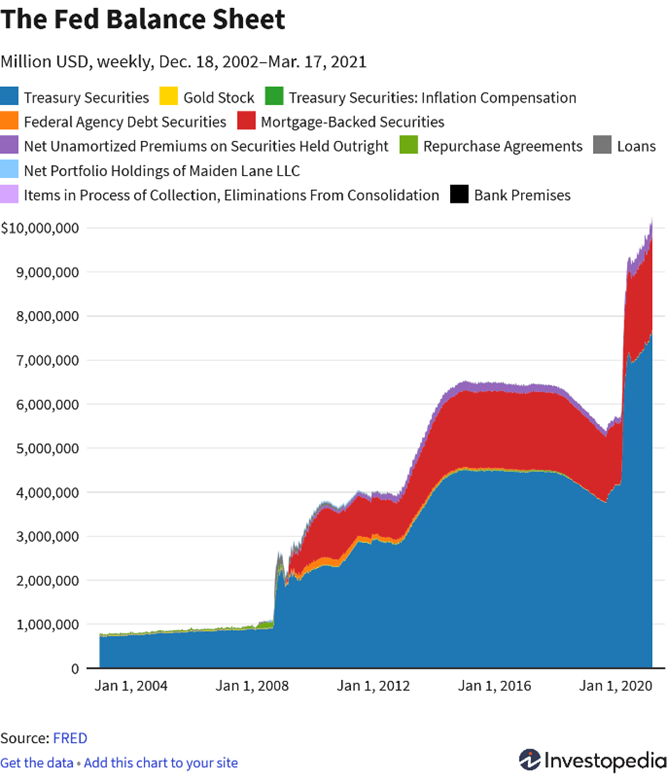

Printer says… – Fiscal Stimulus 2020 – US Federal Reserve and RBI

You came for an equity market recap, but we’re throwing in a bit of central bank policy. Without the central banks’ swift and decisive monetary action, could 2020 have been a record year for equity? The Federal Reserve in the US, lowered interest rates to near zero again. The Fed and the US government took unprecedented action and in the first tranche of the CARES Act and infused $2.3 trillion across a range of efforts. The Federal Reserve dished out stimulus cheques to every citizen. The image below shows how the Fed has stepped up and nearly doubled their balance sheet this past year.

After this massive fiscal stimulus, the Fed announced that it would focus on the medium-term average of inflation, instead of near-term spikes. It has vowed to keep the policy rate near zero till at least 2023 and will keep policy easy at least until pre-pandemic employment levels are reached. Their priority is bringing back employment.

Back home, the RBI reduced the repo rate from 5.15% (pre-pandemic) to 4.40% and then to 4%. It has committed to an accommodative stance until growth resumes. The reserve bank also widened the repo rate corridor (the difference between the repo and the reverse repo rates) to further encourage banks to lend. The RBI issued loan moratoriums and kept small businesses on life support. Even though these moves spelt uncertainty to the financial sector, it was a lifeline to small businesses, NBFCs and microfinance institutions.

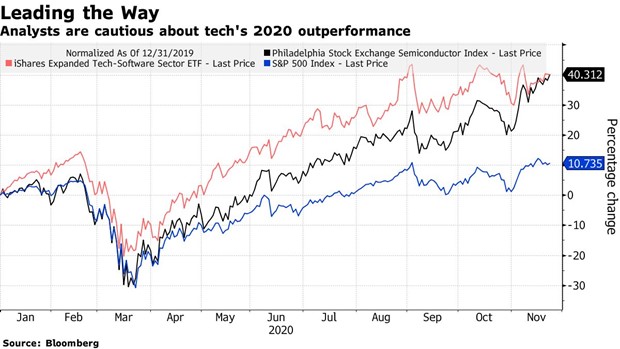

Zoom out for the Big Picture – NASDAQ Stock Rally/ FANG Stock Rally

Even with the world in lockdown, life still had to go on. Work from home was the solution. Since people could not go out, entertainment had to come to them. Demand for e-commerce, cloud computing, video conferencing, and streaming services skyrocketed.

This demand coupled with stimulus paychecks fueled a staggering rally in the tech sector. From the March lows, the Nasdaq climbed nearly 70% by August 2020 and 95% by February 2021. Tesla, a company that had not turned a profit, rose from $85 in March 2020 to $880 in January 2021, a 930% rise. Tesla is now the sixth most valuable company in America. Meaning, it’s more valuable than Visa, JP Morgan and Walmart, and slightly less valuable than the likes of Facebook and Alphabet.

All that Glitters: Gold Investment Returns

From 2010 to 2020, gold’s annual return was 4%. From January 2018 to February 2020, gold’s return was approximately 12% annualized. Currently, it is trading around $1,800/ounce. Historically gold has been used as a hedge against inflation and as a store of value. It has done well in periods of economic distress and high inflation. Oddly, the past year for gold has been extremely volatile.

| Gold | Price (Dollars/ Oz) |

| High | 2,067 |

| Low | 1,474 |

| Current | 1,836 |

| Fall from High | -11% |

| Rise from Low | 25% |

With the central banks of the world still in an accommodative stance and money supply at extremely high levels, we suspect that we haven’t seen the last of gold as of yet.

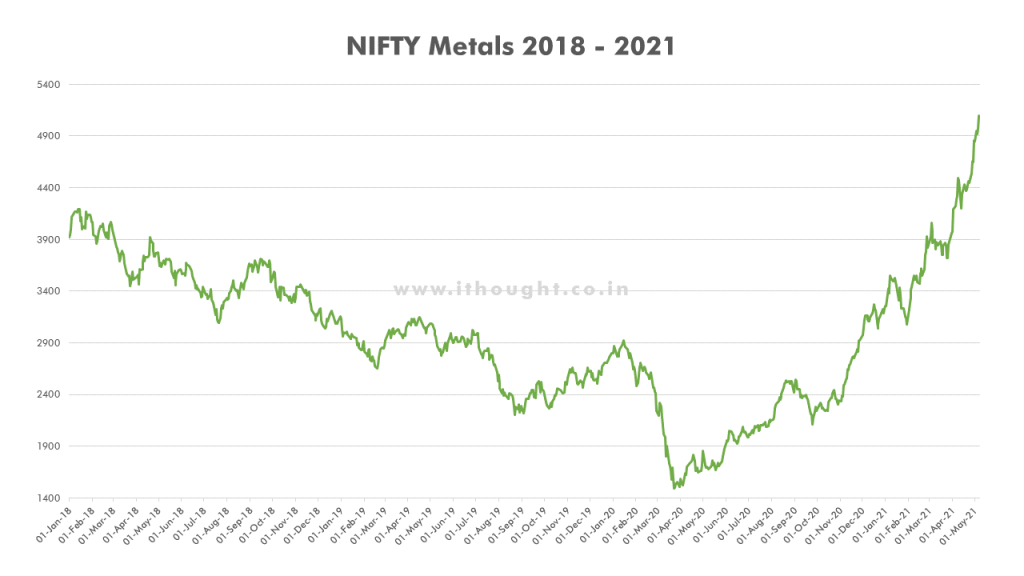

The Rust is off! Commodity Cycle & Metal Stocks

Metals and other commodities are cyclical assets. Cyclicals have their ups and downs. Demand and supply drive the fortunes of commodity companies and commodity prices. As lockdowns relaxed around the world, the pent-up demand for commodities drove prices up.

A sector that was battered for the best part of the last two years suddenly became the most desirable. Increasing commodity prices are not desirable for everyone. The auto and construction industry will be impacted at their cost level and one can expect prices of the finished products to increase. Many auto companies have already announced price increases as of May 2021. This in turn will lead to a rise in inflation.

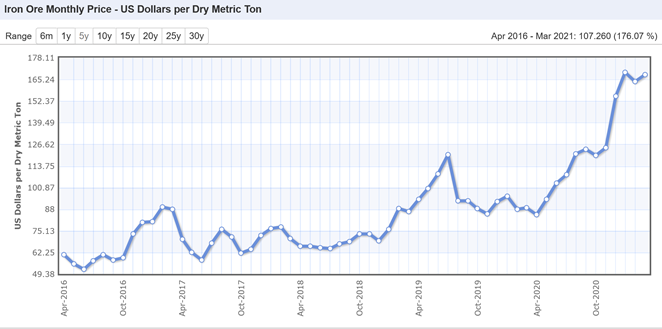

Nobody wanted to touch the metal sector until the later part of 2020. From November 2020 to May 2021, the basket has risen 228% on absolute terms. The chart below shows the price of Iron Ore, one of the base metals.

Before jumping the gun on commodities, one must keep the cyclical nature of the sector in mind. Commodities are subject to violent swings. They can fall much faster than they rise. Getting caught holding the bag could mean years of waiting before even the hint of a turn.

Everybody has a Coin – Cryptocurrencies

The biggest talking point of last year (apart from the virus of course) has been Cryptocurrencies. Cryptocurrencies are at a very early stage so there is no telling as to what they’ll evolve to. Originally, they were meant to be a medium of exchange. This has quickly spiralled to what is now a speculative instrument.

There are numerous cryptocurrencies. We’ll limit this discussion to bitcoin.

In March 2020 bitcoin was trading at around $5,900. From then, it hit its peak in April 2021. A 972% rise to $63,500. Since then, it has corrected 12%. Cryptocurrencies are currently purely speculative instruments. Maybe someday, they’ll evolve into something meaningful that people can use, but right now, they don’t have any investable properties. They don’t pay interest or dividends. They don’t have any physical properties nor do they have intrinsic value. This will continue to be a wait and watch scenario for the foreseeable future.

Key Takeaways

There’s a quote by Howard Marks, You Can’t Predict, but You Can Prepare. The last 15 months are solid proof. Markets had a meltdown and have moved towards mania.

Monetary policy remains accommodative and monetary stimulus is continuing. Inflation looks to make a comeback as well. This spells uncertainty in the financial markets and we need to tread very carefully.

It’s at times like these where one needs to review their position and look at where they stand. To get your portfolios reviewed by our advisors, get in touch with us.