Manufacturing Sector

India’s new growth formula is its manufacturing sector this season. The opportunity for India at this point in time is something that everyone’s talking about.

The post-pandemic world is witnessing geo-political headwinds and there is a dire need for supply chain resilience. The perception for years together was that India’s future lay in the services sector. Unlike other countries where manufacturing growth preceded services, India was an exception. In the last 5 years, the services sector’s contribution to GDP had a growth trajectory from 45% to 55% while the manufacturing sector largely remained stagnant from 15% to 17% with over 27.3 million workers. India has an immense opportunity to increase its share of global manufacturing exports, and the government is seeking to raise manufacturing to 25% of GDP from 17.7% by 2025.

Manufacturing Trends

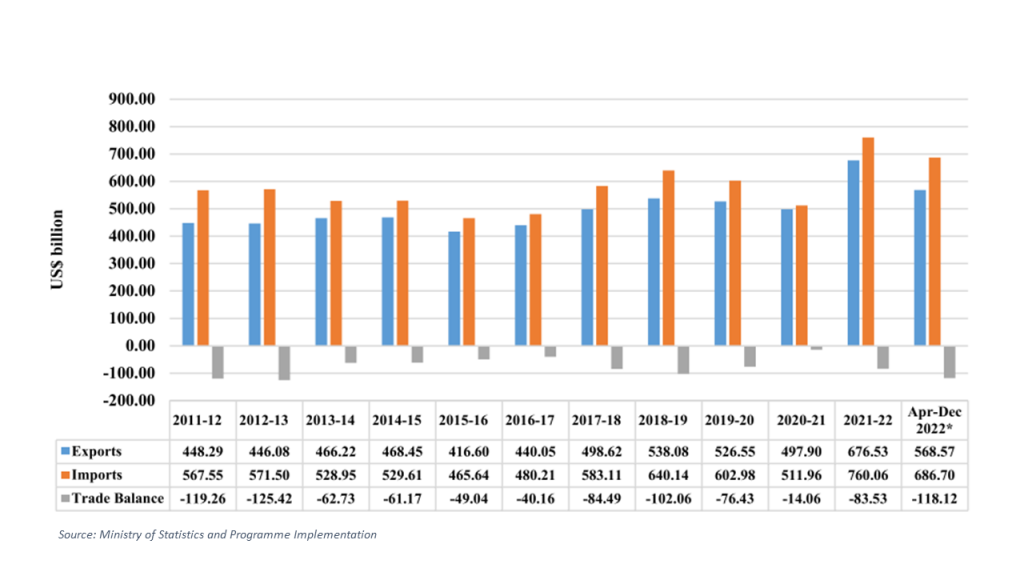

India’s export curve stagnated at about $250-$300 billion for nearly a decade. But in recent years it has surpassed the $400 billion mark.

What is very encouraging is that the bulk of the improvement has come from manufactured goods!

The pandemic brought attention to the shortcomings of the service sector and made policymakers realize that relying too heavily on it would not be advantageous for the economy. The government wanted to create more jobs, boost production, and bridge the gap between supply and demand. Building on the Make in India policy – PLI was introduced.

Industrial Growth

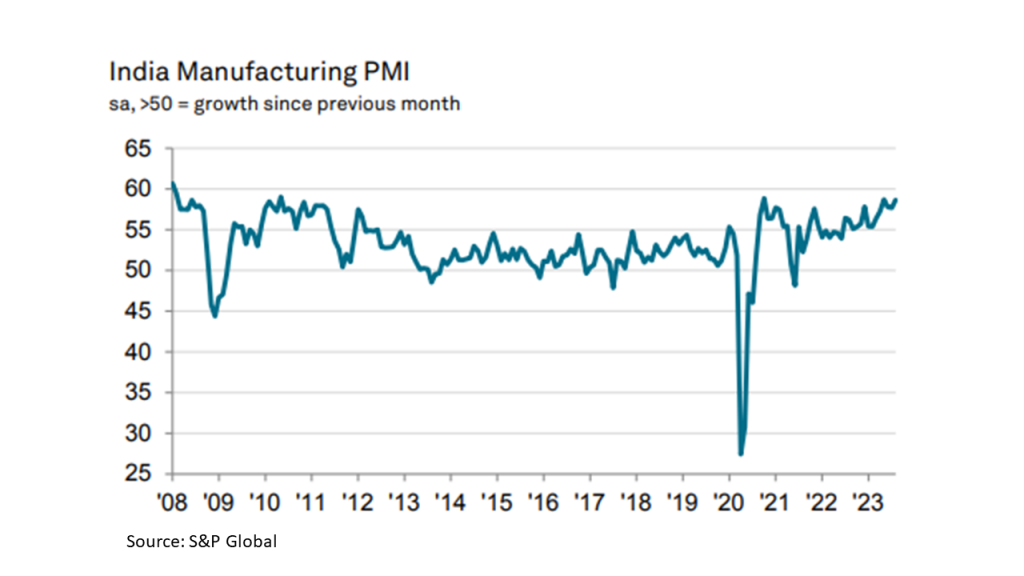

The purchasing manager’s index that indicates the prevailing direction of economic trends shows a robust improvement in manufacturing sector conditions across India as new orders pumped in at the quickest rates in nearly three years during August 2023.

On the price front, cost inflationary pressures accelerated but there was a slower uptick in selling charges which essentially means that there are (i) plentiful resources (ii) low labour costs, and (iii) efficient manufacturing processes.

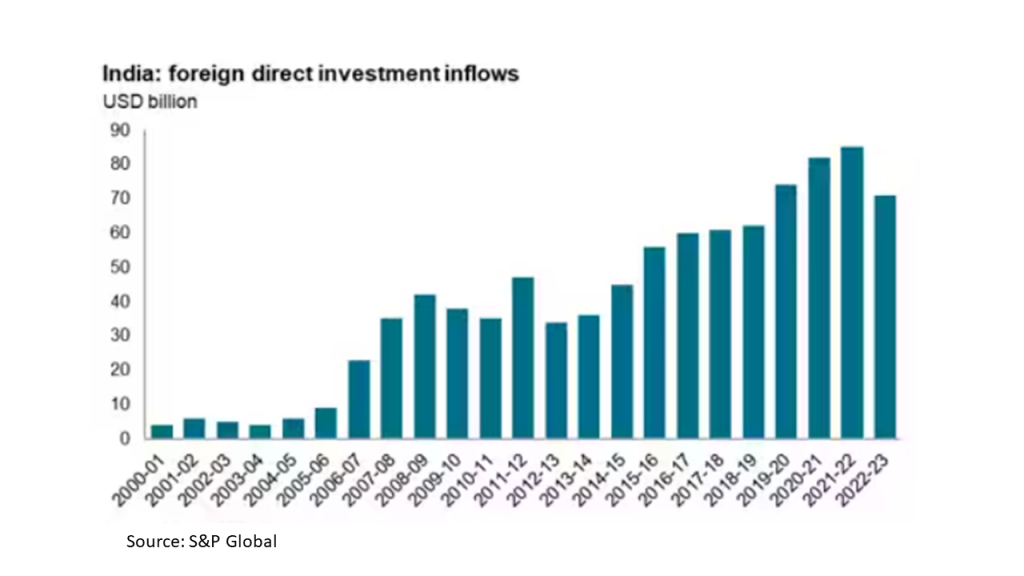

Net new foreign direct investment into India has risen very rapidly in recent years, with FDI reaching a new record level of USD 85 billion in the 2021-22 fiscal year. Although FDI inflows moderated to USD 71 billion in the 2022-23 fiscal year, this compares with FDI inflows of just USD 4 billion in the 2003-04 fiscal year.

US technology firms have been key contributors to recent FDI inflows. In 2020, Google came up with the “Google for India Digitization Fund”, through which it announced plans to invest USD 10 billion. Saudi Arabia’s Public Investment Fund acquired a USD 1.5 billion stake in Jio Platforms and a USD 1.3 billion stake in Reliance Retail in 2020.

By source of origin of FDI inflows, Singapore, Mauritius, and the US were the top four sources of FDI inflows into India in FY23.

Production Linked Incentive

Before PLI India’s presence in the electronics manufacturing sector was just a drop in the ocean.

“India’s share in global electronics manufacturing has grown from 1.3% in 2012 to 3.0% in 2018. The domestic production of electronics hardware has increased substantially from $29 billion in 2014-15 To $70 billion in 2018-19. With the domestic demand for electronics hardware expected to rise rapidly to approximately $400 billion by 2025, India cannot afford to bear the rapidly increasing foreign exchange outgo on account of the import of electronics”.

The first industry that PLI was announced for was electronic manufacturing. In 2018, India’s mobile phone exports were merely $300 million. But 5 years down the lane we’ve come a long way shipping a whopping $11 billion worth of them! From heavily relying on importing mobile phones to sending them to all corners of the world – we are proudly a net exporter now!

And then, India announced Production Linked Incentive Schemes aiming not only at electronics but 14 key sectors which include pharmaceuticals, automobiles, textiles, food products, etc with an outlay of $26 billion to enhance manufacturing and exports.

But are we just an assembly line? Former RBI governor Raghuram Rajan’s post on LinkedIn argued that we are still dependent on imports i.e., we just assemble parts and don’t add value to the end product.

China Plus One and Global Manufacturing

Keeping aside all the debates the PLI surely attracted a lot of global capital from companies like Apple and Samsung. These firms have been trying to reduce their reliance on China and the timing of PLI grabbed the perfect opportunity. Due to China’s low-quality goods, trade conflicts, and border issues, India is currently in a favourable position to profit from China’s deteriorating competitiveness. India is changing its trading approach to benefit from the tailwind of the increasingly popular China-plus-one strategy.

Apple’s manufacturing efforts in India are onward and upwards – it has created more than 1 lakh new jobs in the past 18 months, and this is just the beginning. We have a separate PLI scheme for semiconductors now – so might be that we are on the pathway to building ourselves from scratch and creating a whole value chain.

Make in India

The ‘Make in India’ policy was introduced in 2014 enabling India to position itself as a leading manufacturing powerhouse and to be self-reliant. India could have taken the easy way out by imposing tariffs on imports. However, this would have resulted in Indian customers paying the cost of the policy decision. The self-reliant approach was a long-term strategic move that has ensured that India manufactures high-quality quality competitively priced goods.

The outcomes of this Make in India scheme are three-fold:

-

-

- increase in GDP;

- appreciation of the rupee as FDI inflows increase;

- leverage on low-cost manufacturing.

-

Rising Industry

The Automobile sector has greatly benefited from the Make in India scheme:

The Electric Vehicles manufacturing industry has grown leaps and bounds from its nascent stages. India’s EV sales surged past 1 million in 2023 in less than 9 months! Taiwanese contract manufacturer Foxconn has recently announced its plan to set up a production line for two-wheeler EVs in India.

Several companies including TATA Motors, Mahindra, Hyundai, Ola Electric, Ather Energy, TVS, MG, and others have come up with the electric vehicle segment in the country.

Encouraging policy framework and commitment to reducing carbon emissions is proving right in attracting investments from all over the world.

These big moves are all proving to be good signs for India’s growing manufacturing sector. Looking back, we’ve come a long way, and the coming decade can possibly witness India’s win!