Investment Strategy

It looks like we are near the top of the interest rate cycle. Although this cycle has been shallow, there is still time to act. Bond yields have been consistently dropping and this is likely to continue until the end of the cycle. For investors already locked into long-term debt investments, this is good news. For those with liquidity, it is important to capitalize on opportunities.

Market Outlook

2018 has been an eventful year for financial markets. Fixed income markets are generally associated with lower volatility, but this year has painted a different picture. Yields on the 10 Year G Sec have ranged between 7.12% to 8.12% and are now trading at 7.4%.

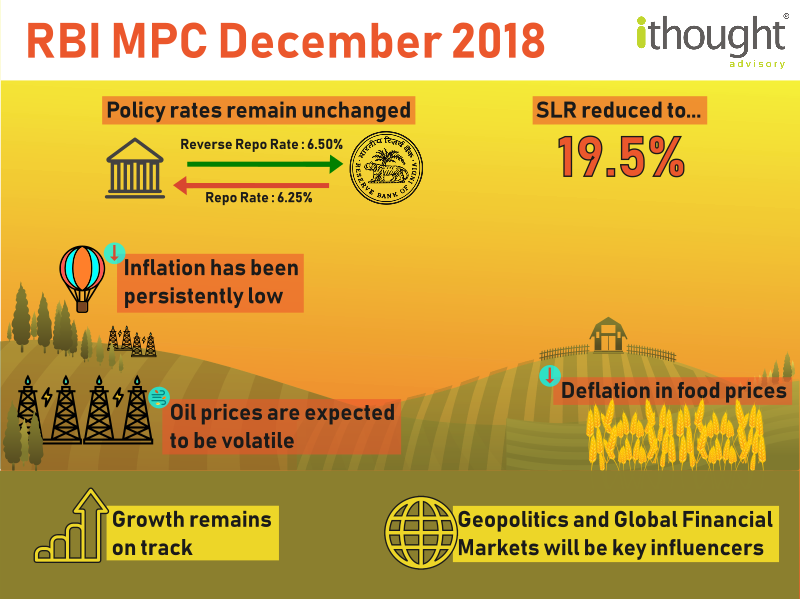

RBI’s Monetary policy plays a key role in shaping the economy. In October, the RBI changed the policy stance from neutral to calibrated tightening. This was in light of rising crude oil prices, higher inflation prints, and tighter monetary policies across the globe. Since then, inflation prints have been consistently low. The US Federal Reserve is likely to slow down the pace at which it increases its policy rate, as they are near their target neutral level. Trade war tensions and crude oil prices have weighed on markets throughout.

The stance of a monetary policy indicates the outlook and approach for the foreseeable future. The way the RBI uses its toolkit (interest rates, liquidity management tools, etc.) can have a more immediate effect. From the last policy meet, the central bank will push liquidity into the markets through OMO purchases. Since inflation has been largely contained, there is little basis for another rate hike.

It’s important to keep in mind that a new governor does not necessarily indicate a different policy.