Economy and Stock markets – The current context

The economy and the stock market paint two different pictures. Globally, the economic slowdown has been continuous and prolonged since March 2020. Financial markets, however, have recovered from their lows. No one knows what sort of volatility or value destruction to expect going forward.

A good way to tide your equity portfolios through these uncertain times is to play a defensive style. Solitaire is a defensive portfolio management service that could work for you.

What did Solitaire portfolio management services do?

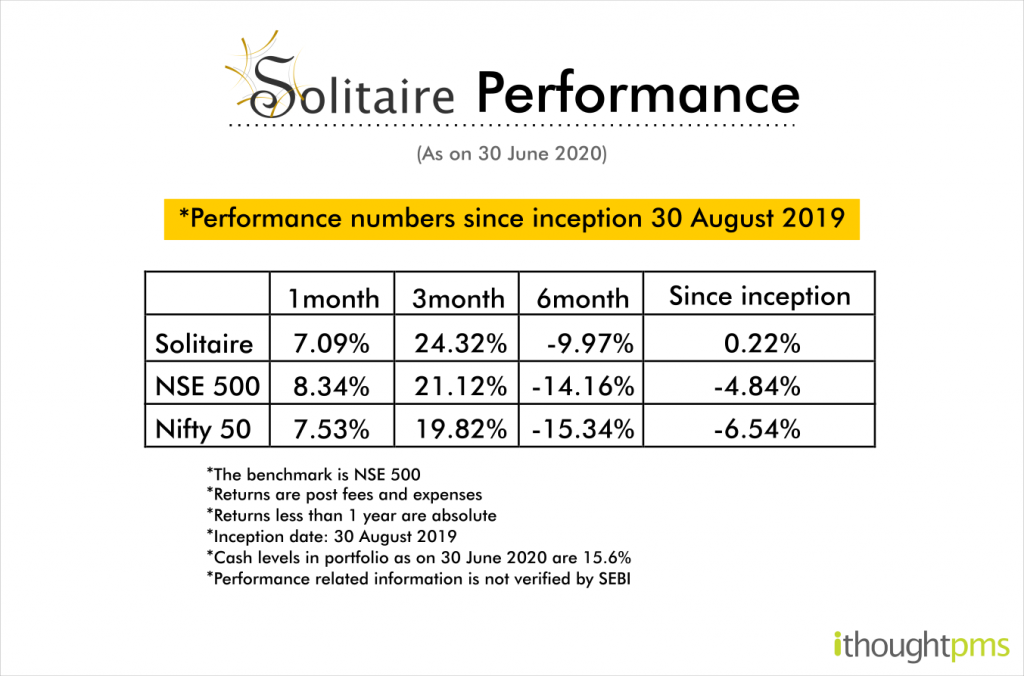

While markets have partially recovered since the crash, some portfolios that have recovered faster than the broader market. Solitaire is one of them. We have successfully used defensive investing strategies to cushion our portfolios and managed steady alpha generation over broader market indices and benchmarks.

Safe investment options in a bear market

Most people believe debt, gold, and liquid assets are the only safe options to invest in during periods of market volatility. Unfortunately, they end up missing out on equity investing when valuations are unbelievably attractive. To avoid this opportunity loss, investing in defensive sectors and stocks is a good way to reap returns with minimal risk.

Defensive stocks provide stable earnings and consistent dividends across market cycles. These are businesses and sectors that have a constant demand despite the state of the economy and cyclical downturns. Defensive investments work exceptionally well during periods of market volatility and economic slowdowns but may underperform during bull markets.

Pharma Sector

An example of this is the pharma sector which saw underperformance through the years of 2015-18 when the broader market was rallying. However, pharma stocks not only survived the crash of March 2020 but also emerged much stronger.

Value investing and defensives

Value investing and defensives are two sides to the same coin. Defensive investments are usually characterised by companies that have strong and uniform cash flows and pay healthy dividends regularly during all market cycles. These traits are similar to those of value stocks.

Defensive investments are better characterised through a value-driven portfolio as opposed to momentum investing strategies.

Defensive investing strategies

Avoid timing the market

Defensive investments outperform during periods of high uncertainty. In most cases, these are sudden events that cannot be predetermined. Examples include the global financial crisis of 2008 and the COVID induced market crash. While trying to catch the bottom, investors may well miss the bus.

Taking cues from global stock markets

Indian equity markets tend to follow the general trend of global markets. The U.S markets and major Asian stock markets have a noticeable impact on Indian markets. In the last three months, pharma, tech, and consumer stocks have emerged global winners.

Review your equity allocation

Asset allocation is an excellent strategy to manage market volatility. Within your equity investments, allocating to defensives is a good way to cushion the downside during economic downturns.

Defensive investments are insurance for portfolios. They are an essential component of your equity portfolios. Revisiting legacy portfolios of 2019 and adapting them to the new market reality is crucial.

Sign up for the ithought investment review engagement to get a professional opinion on how to restructure your portfolio.

Finding a long-term investment

The key to investment performance in coming years is to allocate wisely, to scale up gradually, and to increase your investment horizon. Most investors are not expert bottom-up stock pickers. Yet, the need of the hour is to find long-term investments.

For passive investors, defensive sector ETFs are sound investments for decent returns. For investors seeking alpha generation, actively managed mutual funds or PMS hold the key. Choose products that are managed by industry veterans to stay on the right side of markets in uncertain times.

At Solitaire, we have been early identifiers and adopters of defensive strategies. This has helped insulate our portfolios. Our fund manager, Mr Shyam Sekhar has over 3 decades of experience in understanding how to position portfolios in an evolving market context. We are constantly adapting our strategies to suit the current economic scenario. Our “heads we win, tails we lose far less” approach has proved successful the last few months.

We’re here to talk if you want to know what we did differently and how our portfolios emerged stronger in a turbulent market.