If we follow the news flow, it would appear that RBI cut interest rates by 0.25% following the US Federal reserve cutting interest rates by a similar % in October. This appears to be in line with past trends but if we look deeply into the inflation numbers or US and India and the currency movement we get contrasting views.

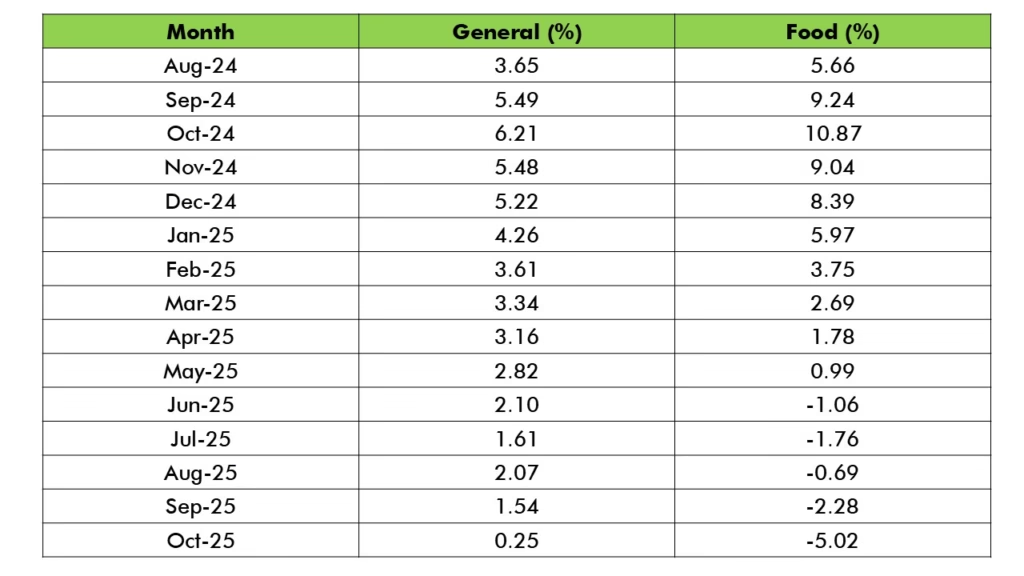

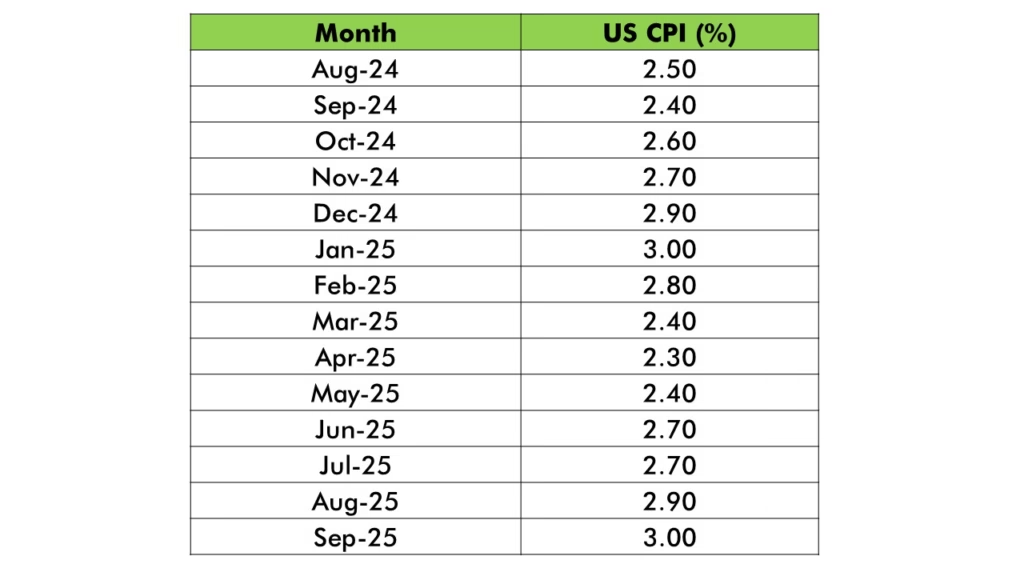

The inflation situation of the US and India point to different pathways. While India’s CPI inflation has moderated to below 1% levels the US CPI inflation is still stuck in the 2%-3% range. While a comparison of a single set of numbers might not be representative, the overall trend of inflation in India points out to scope for RBI to cut rates more while in the US the scope to cut rates further looks increasingly difficult as the inflation numbers continue to be sticky at least as per the current trend.

So from an inflation point of view, it does appear that India could have potentially lower interest rates, however the moderation in the rate cut cycle for now stems from the weakness in the INR vs the USD which breached the 90 level last week. A decade earlier, this could have set off alarm bells in the Govt and the chances of RBI cutting rates might have decreased and people would venture guesses if interest rates need to be increased. For now, it looks like we have passed that phase and so despite weakness in the INR , there has been a rate cut.

We are at an interesting point in the economic cycle and so far the actions of the central banks point out that domestic factors like domestic inflation and growth is a more important criterion than currency volatility.

This has positive ramifications for personal finances as borrowing costs come down. We are seeing home loan rates at 7%-8% levels after a long time. If India’s inflation trend continues to hold then we could see a strong credit flow leading to a growth cycle by sustaining and reviving consumption growth.

India Inflation

US Inflation

Stay ahead of the curve on interest rates, inflation trends, and personal finance strategies. Subscribe now for timely updates and insights that help you make smarter financial decisions.