Around the time when your annual health insurance policy comes up for renewal, a whole bunch of unknown callers reach out to you asking you to renew with their insurance firm citing various aspects like lower price , additional features, claim payout ratio amongst various others.

Likewise, your insurance company folks reach out to you to take a top up or booster plan on your existing policy. I used to ignore these calls until I realized that after all, there is merit in considering them given the rising medical inflation in India.

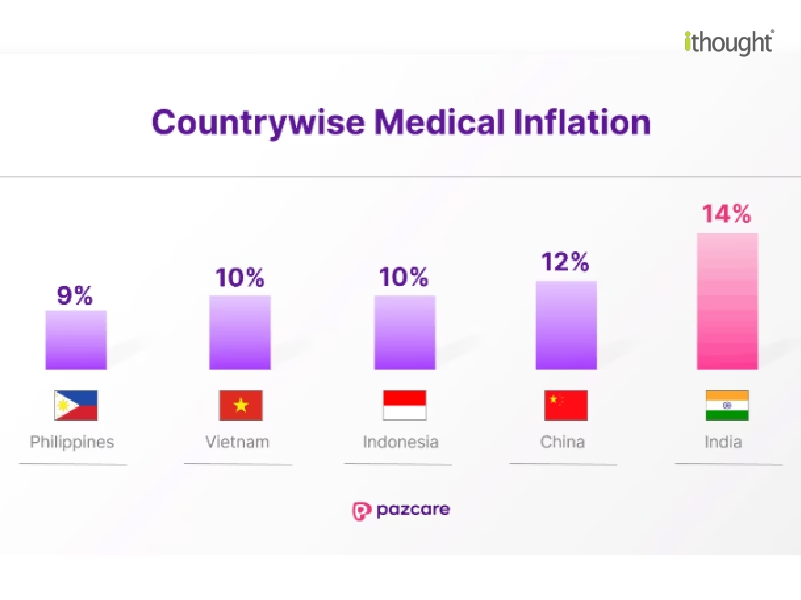

Medical Inflation (the cost of medical treatment) in India is rising at a pace much higher than average consumer inflation. As per some estimates medical inflation in India is growing at a rate of 12%-15% p.a. and as per some estimates it can be even as high as 20% p.a. in some years.

So if you have a Health Insurance Cover for Rs 25 lakhs given this rapid increase in medical inflation your coverage could become insufficient. To protect from such a scenario it would be a good idea to consider a health booster or top up to your existing insurance policy.

For example, you have an existing health insurance family floater policy for Rs 25 lakhs but you feel that it’s a good idea to increase the coverage as the costs of medical expenses and treatment is increasing at a rapid pace. So you consider taking a top up on this for Rs 25 lakhs to take care of such exigencies. So now your coverage increases to Rs 50 lakhs and the additional premium cost would be at a fraction of the cost of the original policy ( in my case it was between 10%-15%).

Of course, there will be terms and conditions like minimum deductible and the booster shall get activated only if the existing health insurance cover is exhausted and many others as we can see in an insurance contract. However , overall this appears like a smart way to cover the risk given the escalating medical costs in India.

In conclusion, healthcare and education costs continue to grow at a rate significantly higher than average consumer inflation. Yet our Income and Investment seem to be anchored towards the consumer inflation rate. So covering the risks in these two spending buckets could help bring stability to our personal finances.