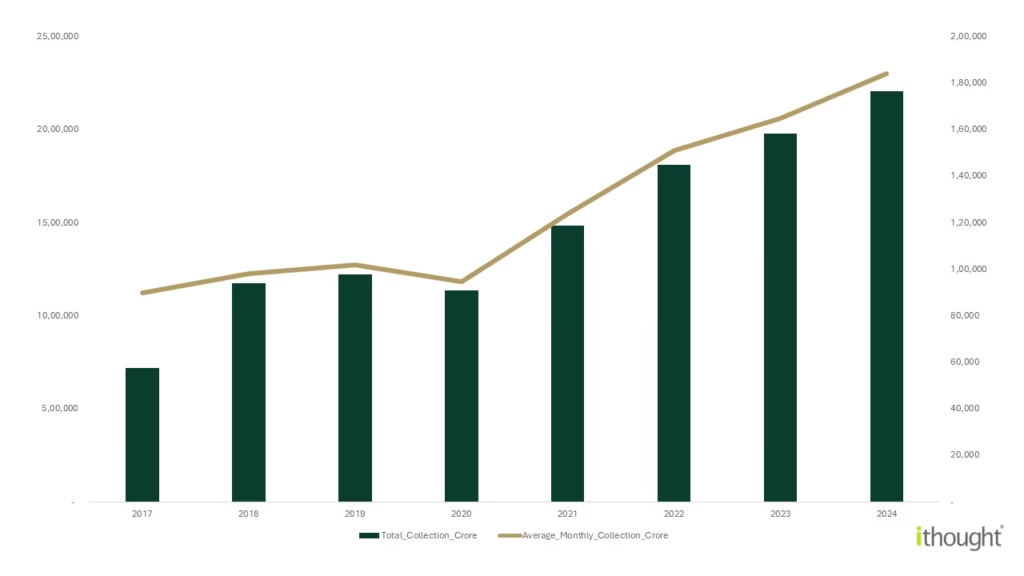

The introduction of the Goods and Services Tax (GST) in India on July 1, 2017, was an ambitious reform, but its initial phase was marked by significant challenges. The government had a target of collecting at least ₹1 lakh crore per month to maintain fiscal stability. However, early collections were inconsistent and often fell short of this mark, leading to concerns about the viability of the new tax system and putting a strain on the Centre-State fiscal relationship.

The initial challenges were multifaceted. They included:

- Technical glitches on the GST Network (GSTN) portal, which led to filing delays and errors.

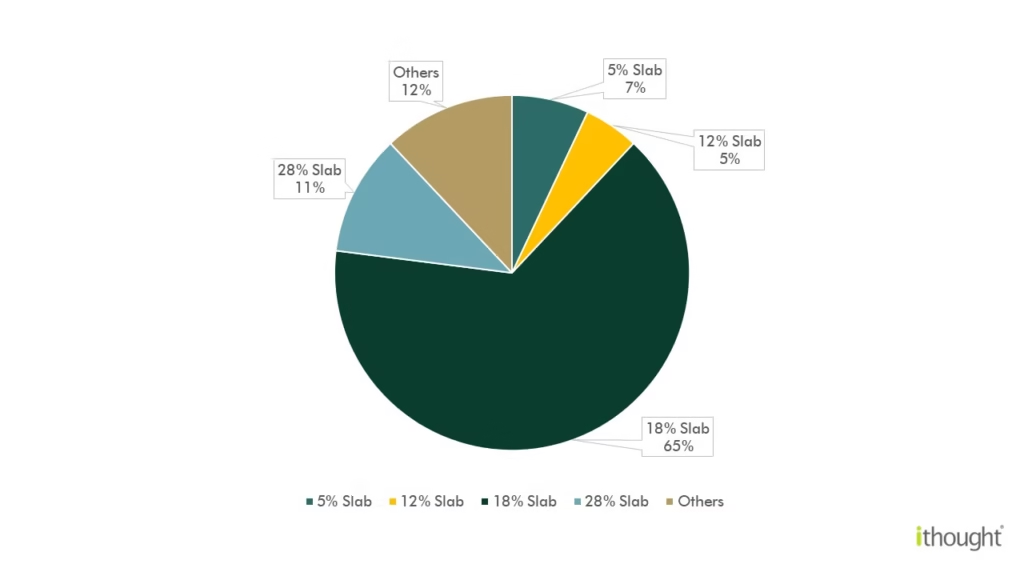

- The complexity of the multi-slab tax structure (5%, 12%, 18%, 28%), which created confusion and classification issues.

- A heavy compliance burden for small and medium-sized enterprises (SMEs) that were not prepared for the digital-first tax regime.

- Cash flow issues for businesses due to delays in Input Tax Credit (ITC) refunds.

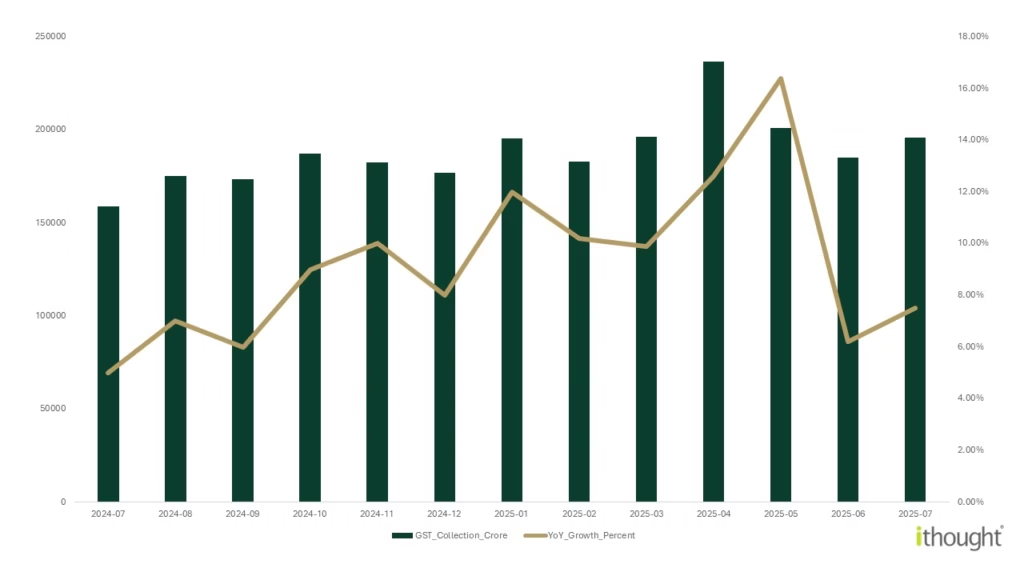

Over the years, with continuous reforms, simplification of processes, and increased digital adoption, GST collections have shown remarkable and sustained growth.

Major Contributors

The original goal of GST was to generate collections amounting to 1 Lakh Crore / month. This target was achieved within three years of GST and declined in 2020 due to the pandemic. But GST collections quickly rebounded after that and there’s been no looking back.

The government looked to revamping GST based on the reform’s recent performance as well as the economic demands of today.

The new GST regime is a game-changer for several sectors, and understanding its impact is key for investors looking to position themselves for future growth.

Rationalising GST:

Benefits

GST replaced a complex system of multiple taxes with a single, unified tax, creating a common national market and eliminating the cascading effect of taxes. This has streamlined logistics, made Indian goods more competitive, and brought more businesses into the formal economy. The online portal has also simplified compliance, while the input tax credit system has reduced the overall tax burden for many businesses.

Challenges

That being said, GST’s implementation faced significant challenges. The initial multiple tax slabs created complexity and confusion for businesses.Small businesses, in particular, have struggled with the compliance burden and the high costs of adapting to the new digital system. Delays in input tax credit refunds have also created cash flow issues.

Upcoming Meetings

56th GST Council Meeting: The next meeting is scheduled for September 3 and 4, 2025, in New Delhi. The agenda is set to include significant reforms, such as the proposed shift to a two-slab GST structure (5% and 18%), rate rationalization for various goods and services like cement and insurance, and a review of the compensation cess.

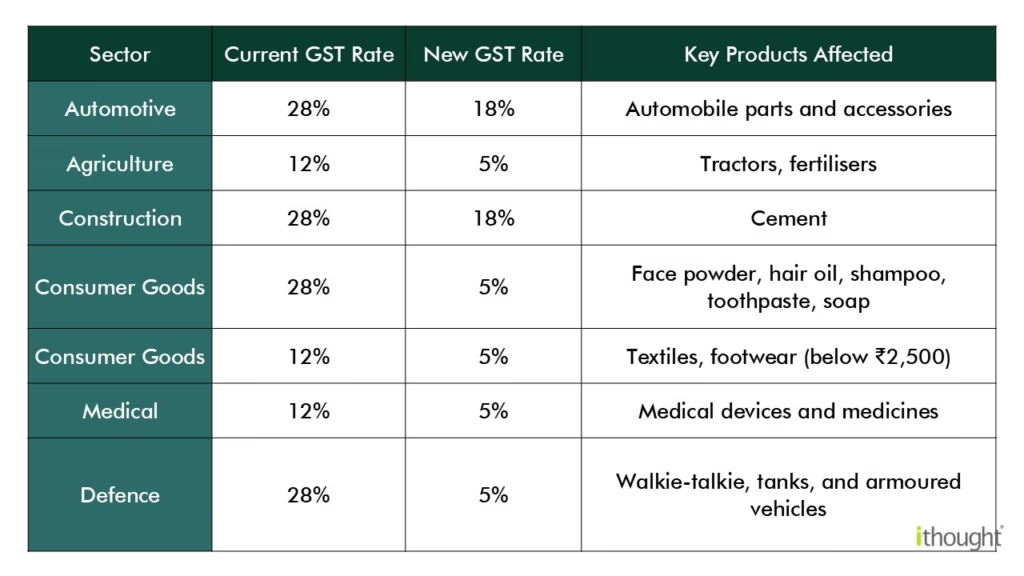

Prime Minister Narendra Modi, during his speech on Independence Day, said that the GST will undergo significant reform, as the 28% and 12% GST rates will be abolished, and the 5% and 18% rates will be made universal to all HSN items (Goods and Services).

4 Sectors Affected By GST Changes:

1. Automotive Sector: Accelerating Demand

The automotive sector is poised to be one of the biggest beneficiaries of the new GST regime. A large portion of vehicles, particularly small cars and two-wheelers, currently fall under the high 28% GST slab. The move to an 18% rate translates to a direct price reduction for consumers, making these products more affordable and stimulating sales volumes.

The demand for these products is highly elastic, meaning a small price cut can lead to a significant increase in sales. This is especially true for the two-wheeler segment and the entry-level passenger vehicle market, which are highly sensitive to price changes. A reduction in tax on two-wheelers will likely drive strong demand, particularly in rural and semi-urban areas, which are key markets for these vehicles. This will translate into higher revenues and improved profitability for companies in this sector.

The proposed GST rate cut is causing a “wait and watch” consumer behavior, with buyers postponing auto purchases in anticipation of lower prices. This is hurting immediate sales, especially ahead of the critical festive season. The auto sector is pushing for quick implementation to avoid a sales whitewash and capitalize on the significant demand stimulus. A swift GST cut is expected to trigger a buying frenzy, making vehicles more affordable and leading to a major surge in sales.

2. Consumer Discretionary & FMCG: A Consumption Boost

The consumer goods and fast-moving consumer goods (FMCG) sectors are also set to gain significantly from the GST reform. Many products in these categories, from consumer durables to packaged foods, currently attract a 12% or 28% tax. The shift to a simplified 5% and 18% structure will directly reduce the tax burden on a wide range of goods, putting more money in the hands of the consumer.

For consumer durables, products like air conditioners and LED TVs, which were previously taxed at 28%, are expected to move to the 18% slab. This will make them more affordable and help clear inventory, driving fresh demand. The FMCG sector, particularly companies with products in the 12% slab, could see their tax rates drop to 5%. While companies might not necessarily reduce prices on popular, low-priced products, the tax savings could be used to increase product volume or improve margins, ultimately benefiting profitability. The overall boost to consumer confidence and discretionary spending will be a major tailwind for the entire sector.

3. Cement & Real Estate: Building a Strong Foundation

The proposed reduction of GST on cement, a critical input for both infrastructure and housing, from 28% to 18% is a major positive. For the cement sector, this change will reduce the tax burden and could lead to increased demand as construction costs for developers and individual home builders come down. This is particularly beneficial for the real estate sector, which has been grappling with high input costs.

Lower cement prices, coupled with the overall economic stimulus, could provide a much-needed fillip to the real estate market. It will make housing more affordable for potential buyers and improve the profitability of construction projects.

The new GST rate reform is set to revitalize the cement sector by addressing key challenges it has faced in recent years. A reduction from 28% to 18% will make construction more affordable, stimulating demand for cement from both housing and infrastructure projects. This will lead to increased production and better capacity utilization. Additionally, the reform will improve sector stability by reducing the “inverted duty structure,” where the tax on raw materials (inputs) is higher than the tax on the final product. This will boost profitability and potentially lead to more attractive merger and acquisition (M&A) opportunities as companies seek to consolidate and gain market share in a more favorable economic environment.

4. Financial Services: The Indirect Beneficiaries

While not directly impacted by changes in GST on goods, the financial services sector stands to gain from the broader economic uplift. The increase in consumer spending and the overall positive sentiment will drive demand for credit, particularly for auto loans and consumer durables financing.

Furthermore, there are proposals to reduce or even exempt GST on individual life and health insurance premiums. This would be a significant positive for the insurance sector, as it would make essential protection products more affordable and accessible to a larger population, thereby boosting insurance penetration in the country. A healthier economy with more disposable income also tends to lead to increased investment in financial products, which benefits banks and other financial institutions.

A Note of Caution and a Look Ahead

While the overall outlook is positive, the market might experience a temporary slowdown in sales as consumers postpone purchases in anticipation of the new rates. The government also needs to manage the initial fiscal impact of these rate cuts, though the long-term goal is that increased consumption will offset any short-term revenue loss. The market should also be aware of a potential new, higher tax slab for “sin goods,” which could negatively impact sectors like tobacco and online gaming.