Will debt come back into fashion? Long term yields in most advance economies and even in India have gone up through 2025. This brings us to a point where risk rewards are far more favourable in fixed income than in other asset classes. Considering the context of a global slowdown, bonds are a more defensive play. In this month’s outlook, we’re going to decode India’s Q1 GDP growth and what it means for rate cuts, yield expansion, why all eyes are on the Fed, and how fixed income fits int your asset allocation.

Yield Expansion

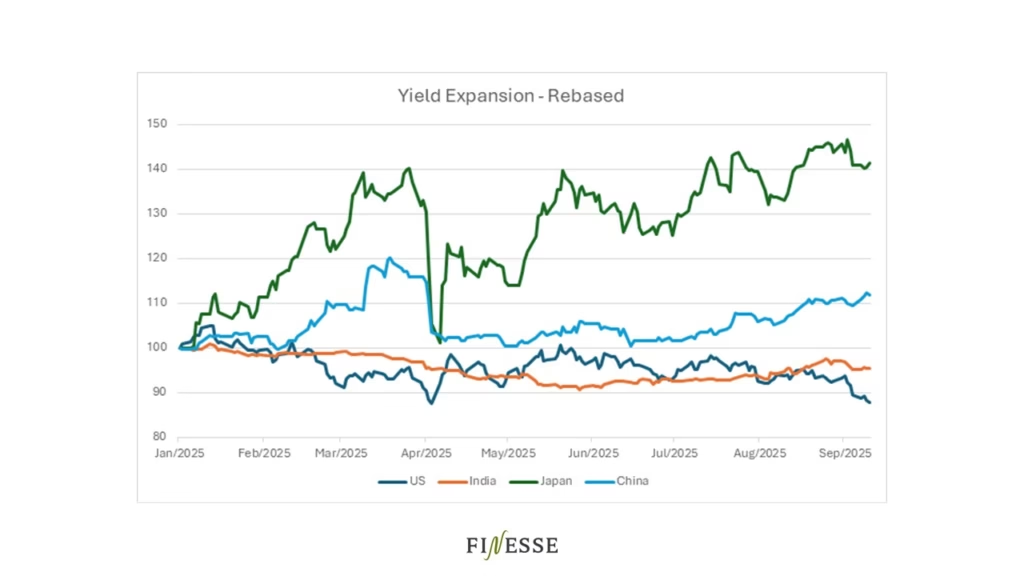

Global yields have expanded significantly in 2025. Japanese yields have seen the widest expansion at the back of rising inflation. The Japanese central bank has been holding off on rate hikes but may not be able to sustain this policy path. JGBs started off the year at 1.15% and are currently trading close to 1.50%.

Chinese yields have also witnessed an expansion of ~0.20%. US treasury yields have cooled since Jackson Hole in anticipation of the Fed’s rate cuts this month. The RBI’s rate cuts caused Indian bond yields to decline, but much of the gains were lost in July and August as yields climbed back.

This brings us to an interesting risk reward state where bonds seem to offer reasonable risk adjusted returns.

India Q1 GDP Data

India’s Q1 GDP growth came in at 7.8% much above the RBI’s projections of 6.5%. This has led market participants to speculate that the rate cut cycle is over. Yet, this data needs to be analysed in greater detail before making judgments on the interest rate cycle.

The first question is that are the numbers lying? There is truth to these numbers. PMI data shows broad based growth across services and manufacturing. While mining activity has been weak, services activity has been strong. More importantly, this isn’t a one quarter trend. Both services and manufacturing have showed resilience in the last twelve months.

The next concern relates to frontloading activity. Has growth been frontloaded in Q1 because of tariff uncertainty and excess government spending. Here again the answer is that economic activity hasn’t been solely export oriented. There’s a lot of domestic activity contributing to growth which is independent of how tariff negotiations play out. Further, government spending in Q1 this year will be higher than last year. This is because 2024 was an election year and elections constrain government spending. Last year the government was slow to spend, this year there was no reason to be slow.

Lastly, private capex needs to pick up. This is a legitimate concern: corporates are not spending as much and will also be slow to borrow given that balance sheets are cash rich.

A lot of this economic activity is a result of policy. Remember that rate cuts and transmissions were underway in Q1, with the RBI starting to cut rates in February and then April. We also had a Budget announcement that put more money in the hands of people. The latest set of reforms pertain to GST. We wait on a set of reforms for the export sector.

While a higher growth figure is welcome, we are far from crossing the finish line. The external environment poses significant challenges to India’s growth story. The RBI minutes show that committee members took a tough call to hold rates when inflation projections are soft and uncertainty is elevated. The goal is to preserve optionality in the face of a changing environment.

All Eyes On The Fed

The focus now shifts to the Fed. Powell at Jackson Hole signalled at a rate cut in September. For the most part, this was very much in line with what was expected from the Fed even before Jackson Hole. After all, the Fed’s last Summary of Economic Projections pointed to two rate cuts this year.

Recent job data is not promising. The Kobeissi letter does a great job of illustrating what’s going on in the US labour market. The revisions to jobs data is worse than what happened during the global financial crisis.

The Kobeissi Letter’s Analysis

Whatever said and done the Fed has a tough hand to play. Inflation is above target, growth is sluggish, and labour market conditions are deteriorating. Remember, the inflation problem hasn’t gone away, it’s just that the labour market seems to need more heavy lifting. As far as recessions go, peak unemployment doesn’t coincide with the beginning of a recession and tends to occur closer to the end of a recession.

Fixed Income – Investment Strategy

There’s no time like the present to consider a safe investment like fixed income. The risk-reward is favourable, interest rates are expected to go lower, and yield expansion offers an attractive re-entry point. Duration plays can be more volatile; volatility must be managed with layering and other complementary strategies.