With equity valuations getting richer by the day, how many safe spaces do investors have left to explore? Equity markets are at an unusual place: small & midcap companies are trading at a premium to their large-cap peers. Flows are keeping markets up and every rally erodes the safety that fair valuations provide. Market participants have become so accustomed to growth being the norm that they are setting themselves up for disappointment. The need of the hour is to think outside the box and get your asset reset right.

There’s a strong case for fixed income in 2024. It’s time to make it your year to shine.

Central Banks: Cautious As Ever

The “not yet” moment for rate cuts is here. Through 2023, markets ignored Fed Chairman Jerome Powell’s vocal concerns about cutting rates too soon. 2024 is turning out to be different. Speculations of a March rate cut have been laid to rest. Powell has warned of market exuberance and its premature reaction to the rate cut possibility. The 10-year US Treasury rose back to December levels after inflation numbers came out. Moreover, the Fed’s January policy did not sound dovish. Inflation management trumps everything else.

With the growth side of the equation running on track, the RBI’s attention is on inflation and liquidity management. One can question what the RBI’s true stance is. Are they leaning towards more neutral policy decisions or are they tightening liquidity? Regardless of the stance, policy efforts are being directed towards taming inflation. And the RBI is prepared for a winding path that gets them to 4% inflation.

Take a look at how hot and cold inflation has been blowing since 2019. We discussed these trends and much more in our last webinar which you can watch here.

Going Long: Are We There Yet?

It’s a good time to think about duration. Bond market investors know that interest rates and bond prices move in opposite directions. So, there’s money to be made when the cycle turns.

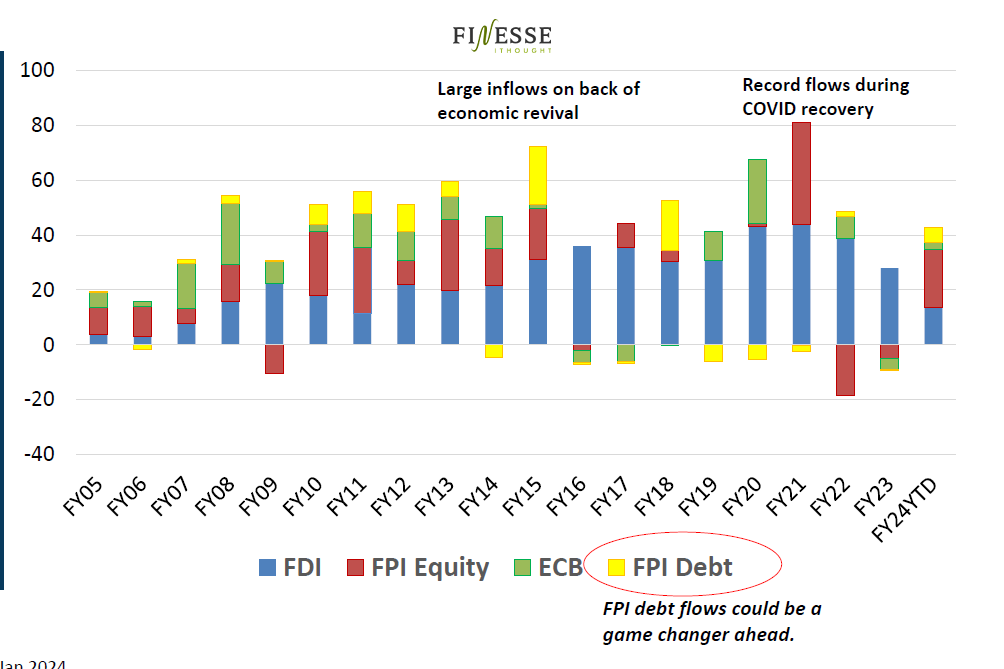

The structural story of long-term Indian government debt is compelling. With Indian bonds being inducted into global indices, foreign interest in our bonds will be sustained. Flows have been incredible this year. And supply isn’t matching up to demand – with the government’s fiscal consolidation plan in motion, there’ll be less debt in the system. These factors could push yields down regardless of whether a rate cut happens.

Playing It Safe

There’s no time like the present to play it safe. At these levels, debt offers attractive returns. Suppose yields rise further, then the risk-reward turns more favourable and demands more participation. If yields fall, investors stand to gain. In the meantime, if equity markets move sidewards – investors don’t lose much. If they correct, not only do fixed income investors protect returns, but they also are prepared for re-entry. If equity markets rally further, investors may lose out on returns, but they also avoid risk.

| Equity Markets | ||||

| Rally | Sidewards | Fall | ||

| Fixed Income Yields | Rise | + – | = – | – – |

| Sideways | + = | = = | – = | |

| Fall | ++ | = + | – + | |

Here’s a quick framework to make decisions:

| Equity Markets | ||||

| Rally | Sidewards | Fall | ||

| Fixed Income Yields | Rise | Shift from equity to debt | Shift from equity to debt | Shift from equity to debt |

| Sideways | Shift from equity to debt | Review Opportunities | Portfolio Protected From Equity Downturn | |

| Fall | Review Opportunities | Review Opportunities | Portfolio Protected From Equity Downturn | |