Energy is one of the critical elements in the trade negotiations between India and the US. Suppliers around the globe are looking to supply the energy needs of India that could be a combination of oil, gas and nuclear supplementing the rapid strides India has made in renewable energy. Beyond oil, access to cheaper natural gas from the US (US natural gas prices are currently lowest priced in the world) and to new critical technology like Small Modular Nuclear Reactors could help India scale up to a new orbit of growth.

While historically the sector has been viewed as a laggard due to lack of scale, the forthcoming scale of demand for energy could place it as one of the critical sectors given the proliferation of Data Centres, shift from LPG to piped LNG, need for energy for powering new age manufacturing amongst others.

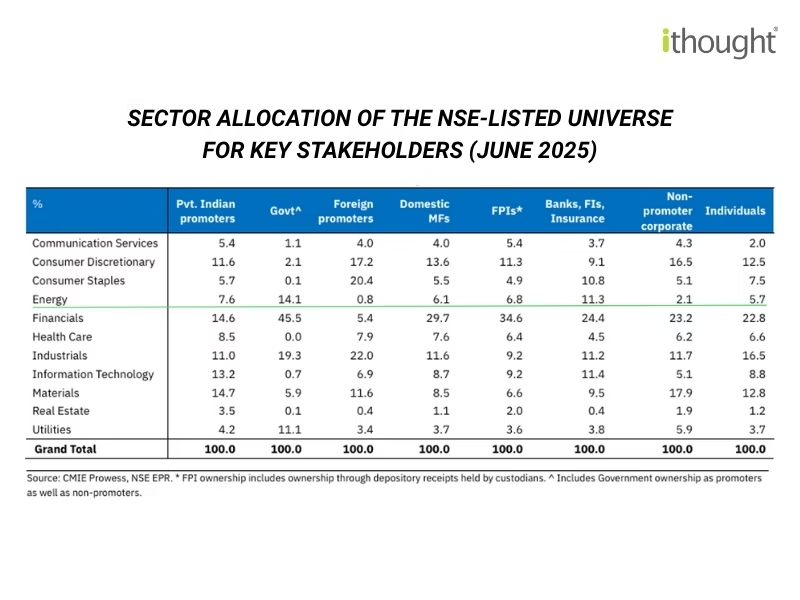

NIFTY Energy has lagged the broad NIFTY in the longer term and yet the sector has seen an improvement in earnings, performance over the last 5 years where the NIFTY Energy index has performed marginally better than the NIFTY. The sector is available at lower valuations with average P/E levels half of the broader indices and strong cash flows, dividends. In addition to valuation comfort, the sector could become a more widely owned sector given its increasingly critical role in future growth :

Given the valuation comfort and the low ownership in the sector , any positives like long term energy agreements could help improve the outlook for this sector making it one of the exciting sectors to watch out for future allocations.