Let me tell you something that no one will tell you: wealth creation isn’t a money game. And I’m sure this invites more questions. If it’s not about how much you have or what you earn, then what moves the needle? The simple truth is that the wealth creation game is all about mindset. It’s not loud, dramatic, or obvious. It’s boring, imperceptible, and quiet. Before we get into this, think about what your goal is: do you want to look wealthy, or do you want to be wealthy?

Becoming wealthy starts here, click the link to connect with us- https://ithought.co.in/contact-us/

The daily habits of people who build wealth silently boil down to three simple and effective things that anyone can adopt.

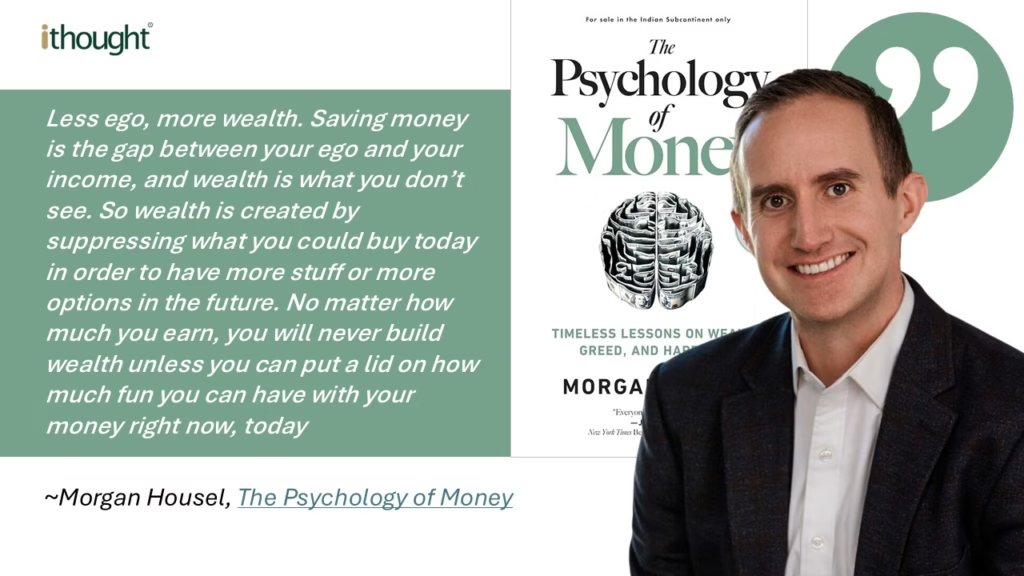

Wealth Is Invisible

In the Psychology of Money, Morgan Housel nails it: wealth is what you don’t see. It hides in the sports cars that you avoided buying, the swanky new apartment that you didn’t purchase, and the luxury handbag that you passed up on.

Wealth also hides in very practical places. Like the health insurance policy that pays for your hospitalisation expenses. Or the life insurance policy that you’ll probably never benefit from. Even the emergency fund that tides you through a rainy day. Or your boring stocks, boring SIPs, and boring financial assets that you can neither see nor show off. It’s not just about making money while you sleep, it’s also about sleeping well.

Invisible wealth comes from maintaining a positive cash flow and keeping your net worth positive. The harsh reality is that most people who look rich on Instagram could be living paycheck to paycheck or have a negative net worth. What they have is not just a fancy lifestyle, but a mountain of credit card debt that isn’t going away in a hurry.

The bottom line is that appearances are deceptive! Those who understand that wealth is an experience, and not an item to showcase will end up with more of it.

Wealthy People Spend Better, Not More

Wealthy people spend better, not more. Warren Buffet’s time-tested advice for markets, works with spending decisions too: Price is what you pay, value is what you get. Wealthy people know how to extract value from every purchase. Sometimes this looks like they’re spending more, but more often not, they know exactly what they’re getting.

In a viral video last year, the world discovered that luxury bags sell for thousands of dollars, when it takes less than a hundred dollars to make. This is a classic case of price versus value. A luxury good certainly has signalling value – it tells others that you’re well to do. But the question is how much that signalling is worth. Only in a particular context or network, the trade-off makes sense. From a functional perspective, a bag is a bag. While the wealthy may spend more for quality and longevity, they’re unlikely to do it simply to please or impress others.

Anybody can spend better by following three simple rules:

Plan your larger expenses ahead

There’s always going to be a large expense in your life: whether it’s a vacation or a car or an indulgence. Saving to spend leads to more intentional spending and inculcates financial discipline. Planning larger expenses also gets you into a milestone mindset and ensures that you’re not just chasing a shiny new thing that you’ll get bored of in a few weeks.

Think Over Unplanned Expenses

It’s normal that you are invited to a last-minute trip with friends, or an outstation wedding. No matter how much you plan, life has a way of throwing spontaneous opportunities at you. The goal is not to be a miser and decline every opportunity to have fun, but to take a conscious approach to spending money.

Social media is filled with ads these days. The world is marketing to you and it’s easy to get caught up in the moment. Impulse buying erodes your control over your wealth. Controlling your impulses is not about saying no, it’s about saying yes after reflection.

Living Below Your Means

Common advice is to live within your means, but the wealthy have found contentment in living below their means. When you start seeing financial success, there’s a tendency to spend more just because you can afford to live “better”. Lifestyle inflation is one of the biggest hurdles to wealth creation.

Let’s take a look at Tara and Nisha’s saving habits. Both of them follow a similar career trajectory in terms of earnings. But Tara’s more diligent with her finances and keeps her expenses in check. With every pay raise she allows herself to spend more, but the bulk of it goes into savings. Nisha believes in the power of saving. She heard from a Finfluencer that a 45%-50% savings ratio is very healthy. So, she’s convinced that if she saves half her paycheck, she’s on a good wicket.

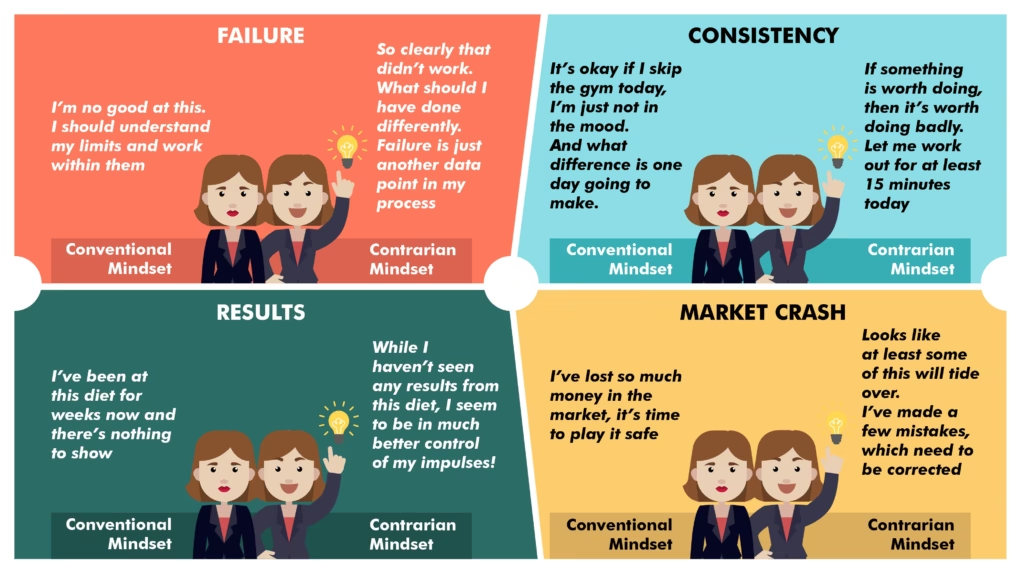

Contrarian Mindset/ Thinking

The wealthy approach life with a different mindset. They don’t see saving as a chore, or something that deprives them of a good life in the present. Instead, to them saving is about paying their future selves first. When you spend money, you own the thing that you buy. When you save money, you have the flexibility to own things. The wealthy are more like Tara, they know that making money while they sleep is more important than spending money while they’re awake.

The contrarian mindset is about identifying opportunities, going against the grain of conventional wisdom, and treating problems as stepping stones. It’s about avoiding urgency and making more meaningful and long-term decisions.

The secrets to being wealthy are not well kept. Anybody can learn them and anyone can adopt them. It’s time you start fulfilling bigger dreams and there’s no better time to start than now!”

Your wealth journey begins here- Click here to take the first step