Indian equities are undergoing a healthy but uncomfortable reset in the broader market even as the headline Nifty 50 index is only modestly off its highs. This divergence is creating a fertile hunting ground for long‑term investors willing to look beyond the index and focus on fundamentally strong businesses now available at more reasonable valuations.

How much the broader market has fallen

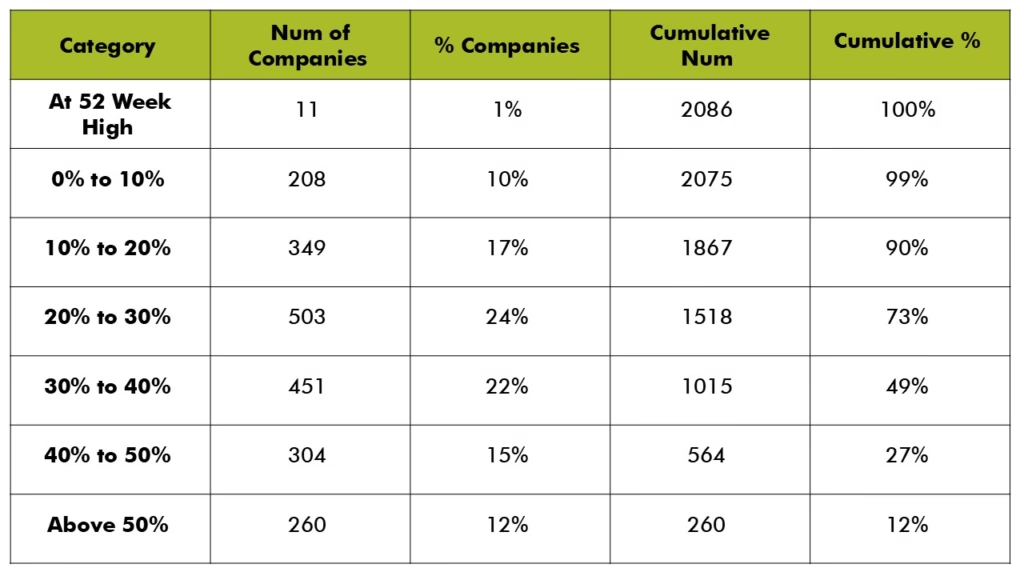

Our universe of the top ~2,000 Indian stocks shows that the correction beneath the surface is far deeper than the index suggests. As of 20th January 2025:

- Only 11 companies (about 1%) are still at their 52‑week highs.

- Roughly 73% of stocks are down more than 20% from their 52‑week highs, and 12% have corrected over 50%.

Put differently, while the screen may show a market hovering near peak levels, most individual stocks are already in a bear‑market type drawdown. This is classic late‑cycle behaviour where leadership narrows even as breadth weakens.

Nifty index vs real‑world pain

The Nifty 50 has declined only a few percent from its 52‑week high, and still shows a healthy 9–10% gain over the last 12 months. Heavyweights in banking, IT and select industrials have cushioned the fall, keeping the headline index resilient.

In contrast, small and mid‑caps, as captured by the broader BSE Smallcap and Midcap indices, have fallen materially more in recent weeks, with the BSE Smallcap index correcting nearly 4% in just the first few sessions of 2026 alone. This gap between index performance and underlying breadth explains why portfolios with higher SMID exposure may feel far more pain than what the Nifty’s behaviour implies.

Several forces are at work behind this under‑the‑surface reset.

- After years of strong returns, valuations in many small and mid‑caps had moved well ahead of fundamentals, leaving little margin of safety once liquidity tightened.

- The market is transitioning from an era of easy money and abundant risk appetite to one where investors increasingly demand earnings visibility and balance‑sheet strength.

- As volatility rises, flows tend to rotate back into perceived safety—large, liquid Nifty names—worsening drawdowns in the broader universe.

For disciplined investors, this phase is less about predicting the next 3–6 months of index moves and more about using the opportunities provided by the market volatility.

Where the opportunities lie

History suggests that some of the best long‑term returns are earned when fear is high and breadth is weak, provided capital is allocated to fundamentally strong franchises.

Corrections of 30–50% in quality companies with intact earnings power can significantly improve future return potential, especially where business models are gaining market share or benefiting from structural tailwinds.

This is also a favourable environment to stagger fresh allocations: adding gradually on weakness rather than chasing momentum at new highs.

While the headlines may oscillate between optimism and panic, the underlying reset in the broader market is creating precisely the kind of opportunity set long‑term investors wait for.

Staying invested, staying selective, and using corrections to upgrade quality remains the core strategy in the current environment.

As a house, the focus in this phase is on protecting downside while positioning for the next leg of wealth creation.