Any financial institution in the world places very high importance for liquidity. Many of the world’s leading institutions have survived for centuries because they have managed liquidity exceptionally well while others have failed because of poor liquidity management. In the financial panic of 1907 in the US, financier J.P. Morgan rallied other New York bankers to use their own capital to provide liquidity to the system and shore up failing banks and trust companies, preventing a total collapse of the financial system.

Since then, liquidity reserves have become a central part of the framework for regulation for not only the institutions but for credibility of any country’s financial system. When liquidity is such an important aspect for the economy and financial system then it is imperative that we give its due importance in our personal finances.

Before we go ahead , let us look at a definition of liquidity :

“Liquidity” is the ease and speed with which an asset can be converted into cash without losing significant market value, with cash itself being the most liquid asset.”

Note the key aspects:

- Ease and Speed

- Without losing significant market value

There should be ease and speed of converting the asset into cash so it should be very convenient. While money market mutual funds, debt funds and almost all mutual funds offer fast liquidity thanks to settlement and nature of product there are other products like closed ended funds and AIFs where liquidity cannot be got with ease and speed.

The second is even more important i.e. without losing significant market value . In some cases like real estate or micro cap stocks if we need immediate liquidity then we might have to do so at distress valuations that are 20%-30% below expected value levels. Therefore, one needs to be cognizant that the expected value that we have factored also should factor for liquidity.

It is important that we consider the importance of liquidity in our personal finances like Institutions do. One of the ways to do it would be to do an Annual Liquidity test.

Annual Liquidity Test

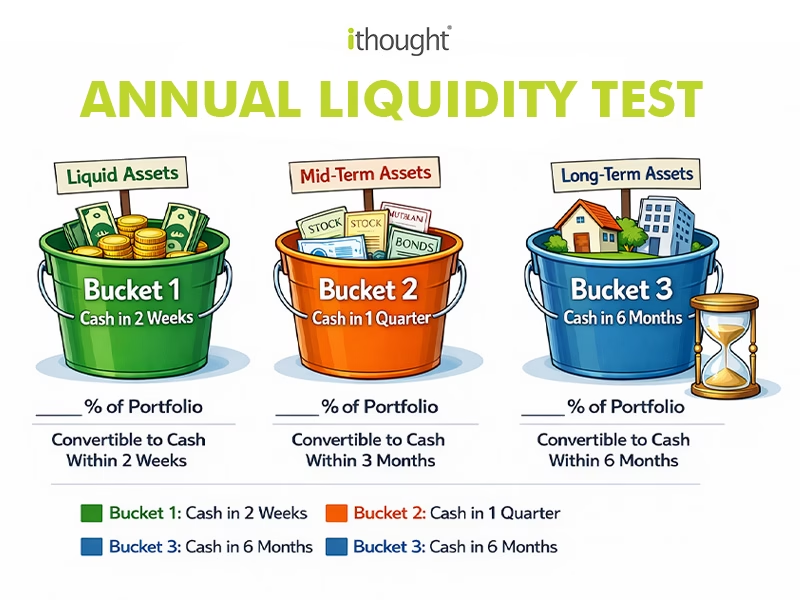

Every year list down all your assets and split them into 3 buckets

Based on the answers we can understand your Liquidity profile.

If you have more than 30% in Bucket 3 then you should take steps to understand the liquidity profile of your overall portfolio and take corrective steps.

Finally , while each individual portfolio might have a different liquidity profile and the lens with which one views is personal, one needs to have a keen eye on liquidity of your overall personal portfolio as this is an issue that not addressed at the right juncture could snowball into a bigger problem.