Retirement investment options in India are evolving and they have some distance to cover before they reach global norms of defined pension plans where a sum of money comes to them after retirement. While the National Pension Scheme (NPS) has been around for more than a decade , it is still in early stages of adoption across corporate India as the main retirement vehicle.

In our interactions with many retirees, we have seen this issue crop up repetitively. They feel pure fixed income options offer safety and liquidity but give a lower return while equity investments do offer higher returns but are volatile and may not be always conducive to withdrawals and liquidity.

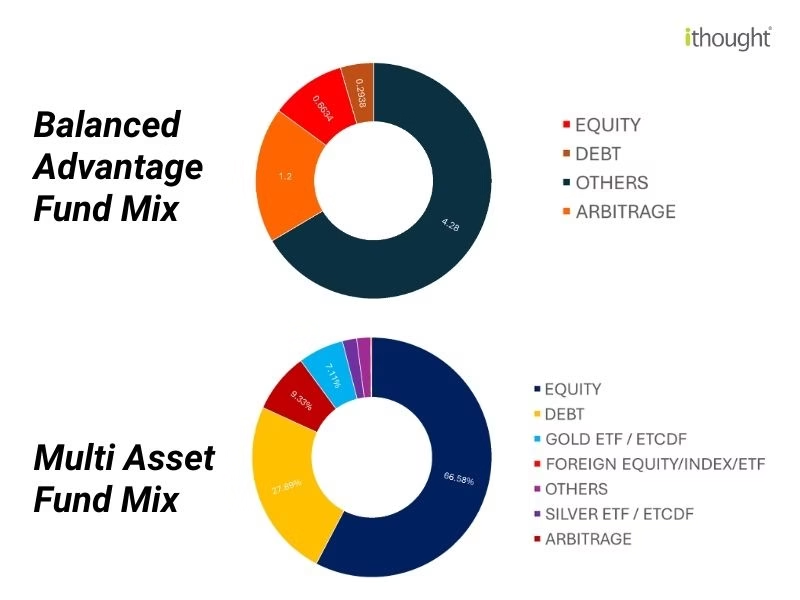

Hybrid and Multi Asset investment options fit right into the middle of this mix offering a better risk adjusted return with lesser volatility from which we could also take out liquidity needed after a few years.

This is because they are an ideal complement to increase the return for a typical fixed income retirement portfolio invested in bonds and fixed deposits and they can also reduce risk of a portfolio that is largely oriented towards Equity. In addition to this, as they are less volatile than traditional equity options they can in the future become an avenue for liquidity through instructions like SWP (Systematic Withdrawal Plan) that can offer monthly liquidity for retirement needs.

While Hybrid Funds mix Equity with Debt and debt like investments, Multi Asset Funds also include other assets like precious metal like Gold ,Silver and international ETFs.

Overall, retirees should evaluate making Hybrid and Multi Asset Funds as an important part of their retirement portfolio as they offer returns with moderately lower risk and liquidity options to meet their needs.