China and Gold shine, but India’s domestic engine keeps markets steady

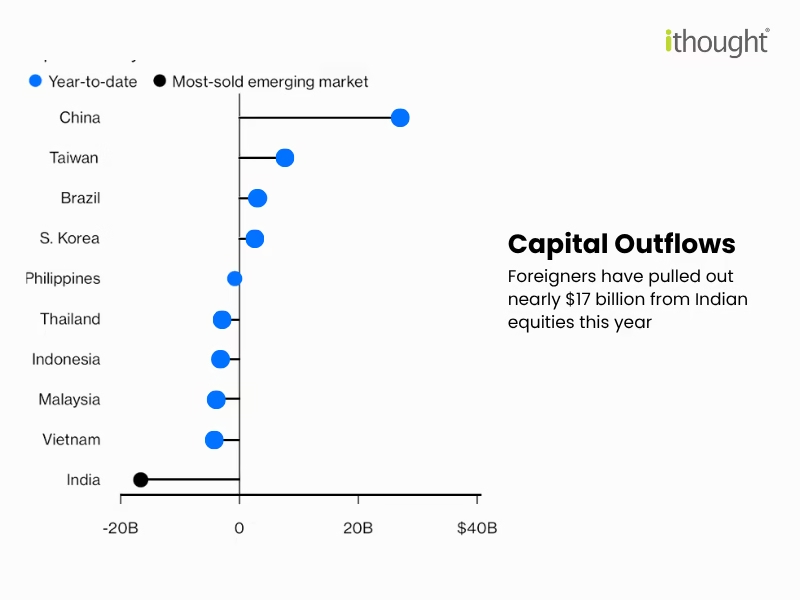

Foreign investors have not fled India — they’ve rotated. After two years of strong equity performance, global capital has shifted toward trades offering more immediate returns. In 2025, that meant reallocating to China and gold.

The Rotation Trade

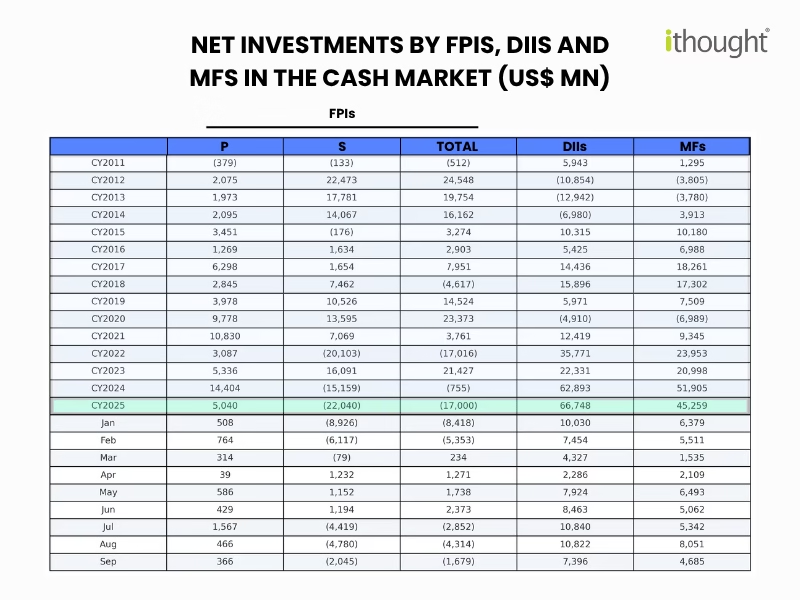

Foreign portfolio investors (FPIs) have sold roughly $17 billion worth of Indian equities this year, making India the most-sold emerging market. But this selling is not about panic or loss of confidence — it’s profit-booking after two exceptional years.

China, coming off multi-year lows, drew heavy inflows as valuations looked attractive. Global funds also poured over $15 billion into gold ETFs by August 2025, chasing safety amid geopolitical tensions and softer U.S. yields. The twin “China + Gold” trade offered both rebound and protection.

India, in contrast, became a relative underperformer compared to global markets like China, Japan, Europe, and the U.S. this year — making it a natural source of profit-taking.

The Domestic Counterweight

Despite foreign outflows, India’s markets held firm. Domestic institutional investors (DIIs) bought $66.7 billion of which mutual fund buying was $45.3 billion, fully offsetting the $17 billion of FPI selling.

Monthly SIP inflows of around ₹28,000 crore have become a structural anchor. This domestic bid ensures that foreign flows no longer dictate market direction. In effect, Indian households and institutions have replaced global capital as the marginal buyers during corrections.

The Cycle Turns Next Year

History shows that following two strong years of FII outflows accompanied by currency depreciation, the subsequent year has typically seen FII inflows return. This pattern reflects global portfolio rebalancing cycles — capital exits expensive markets only to re-enter when valuations and currency stability improve.

India is approaching that inflection point again. Valuations have moderated, the rupee has adjusted, and relative positioning in global emerging-market portfolios is now underweight.

Earnings Reset: A Stronger Base for FY27

Analysts have trimmed earnings estimates for FY26, providing a more realistic base for the next year. This reduces the risk of disappointment and sets up the potential for earnings upgrades from the Q3-Q4 FY26 quarters onward.

As downgrades largely flow through post-September, sentiment should stabilise. FY27 earnings growth is now expected to be in the mid-teens, a pace consistent with India’s long-term trend and sufficient to support valuations.

The Takeaway for Investors

The 2025 foreign rotation is not a red flag — it’s a reset. Global investors are diversifying their winners, not deserting India. Meanwhile, domestic inflows remain robust, earnings expectations are more grounded, and valuations are becoming supportive.

When foreign capital rotates, it eventually returns to growth — and India remains one of the few large markets offering that combination of growth, liquidity, and policy stability.