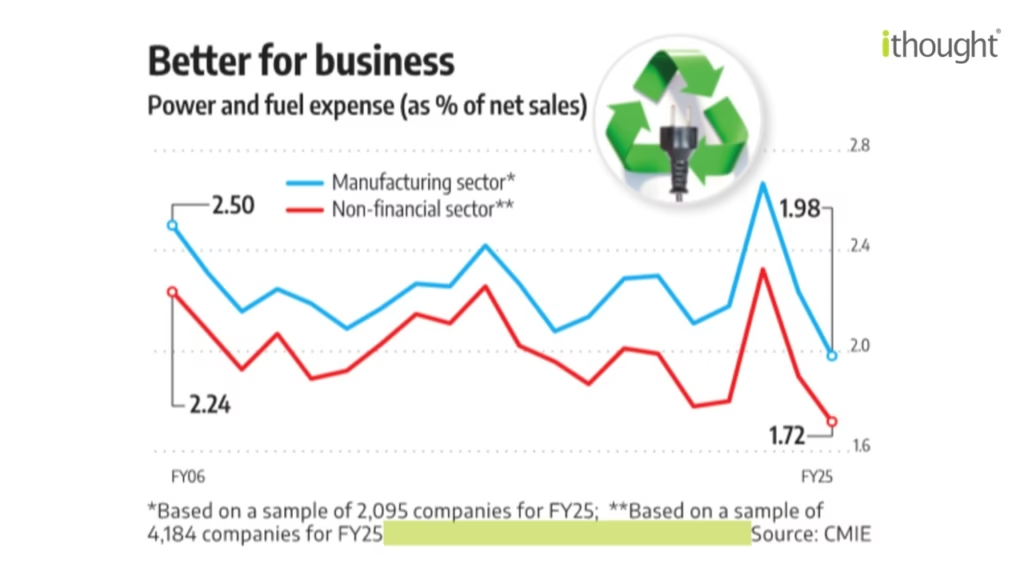

For years, high energy bills have weighed heavily on Indian industry. Now, change is underway. Factories are seeing the cheapest power in two decades.

In 2024–25, power and fuel costs made up just 1.98% of net sales. That is the lowest in the past 20 years according to CMIE data.

In the April–June 2025 quarter, the figure fell further to 1.92%.

For a broader universe of 4,184 non-financial companies, power & fuel costs are just 1.66% of net sales.

Why It’s Happening

- Firms are investing in captive power generation. Captive solar or wind is easier than a coal or gas based power plant.

- Renewables are cheaper at only ₹3–4 per unit.

- Technology and conservation measures are improving.

Together, these trends reduce reliance on expensive grid power. Usually, power to industries is sold at a higher rate compared to households by the State Governments.

Who Gains Most

Industries that use a lot of energy will gain most—cement, aluminum, chemicals, textiles.

SMEs also benefit as they have thin margins. Energy savings help in their survival and growth.

Exporters win too, as cheaper power makes Indian goods more competitive.

What It Means for Investors

This shift can reshape profit pools to some extent. Companies with high power intensity may see stronger earnings and healthier balance sheets.

For investors, there is a second-order play as well. Firms with high energy costs are now investing aggressively in renewables and captive plants. By owning these companies, investors can indirectly participate in the renewable energy and industrial capex cycle—without buying pure-play power stocks which are asset heavy. In effect, energy-intensive manufacturers can serve as a proxy play on India’s renewable and power capex theme.

Big Picture

India may have crossed an energy tipping point. For the first time in decades, power is becoming an enabler rather than a constraint.

Cheap energy supports industrial growth, jobs, and exports. For long-term investors, this is a powerful tailwind.

Energy won’t just be a cost line anymore. It may become a differentiator.

Source – Business Standard