The small and mid-cap (SMID) sector has been on a remarkable journey, delivering exceptional returns that have left many investors wondering if the party can continue. Recent data reveals some striking patterns that demand our attention as we navigate the current market environment.

The Numbers Behind the Historic Outperformance

The magnitude of SMID’s dominance over the past five years becomes starkly evident when examining the raw numbers. Nifty MidSmallcap 400 delivered an extraordinary 29.09% CAGR from August 2020 to August 2025, compared to Nifty 50’s solid 17.58% CAGR over the same period. This is ~11.5 percentage point outperformance.

When a segment consistently outperforms than the broader market’s bellwether index, it inevitably attracts capital flows that push prices beyond fundamental justification leading to unsustainable valuations.

Valuation Concerns Mount

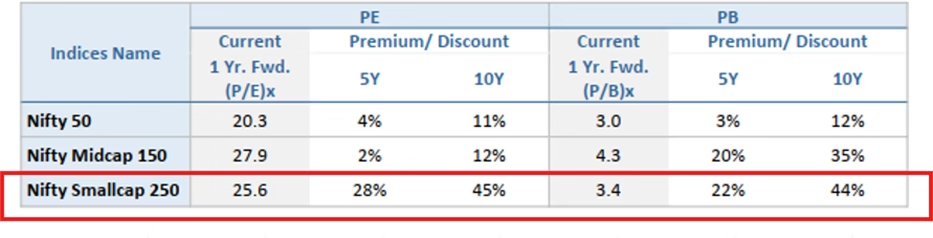

The SMID rally has pushed valuations to concerning levels.

Both Nifty Midcap 150 and Nifty Smallcap 250 are trading at a premium to historical averages.

Earnings Growth Challenges

The sustainability of current valuations faces significant headwinds in terms of subdued earnings growth.

In the on-going Q1 FY26 results season, out of Nifty Small Cap 250 companies around 144 companies have declared the results and the performance is muted with 6% sales growth and 3% profit growth.

With the overall macro environment becoming increasingly challenging due to shifting global trade policies, protectionist measures, and evolving supply chain dynamics, investors must temper their earnings growth expectations for the near term and adopt a more cautious stance toward growth- dependent segments like SMIDs.

Strategic Positioning

Given the current environment, investors should consider:

Portfolio Rebalancing: Consider taking profits in overvalued positions and rotating toward undervalued large caps

The key for investors is recognizing that the extraordinary returns of the past five years are unlikely to repeat in the near term. Instead, a more selective, valuation-conscious approach focused on quality companies with sustainable competitive advantages will likely yield better risk-adjusted returns.

The views expressed are based on current market conditions and available data.