In this blog, we will be talking about silver as an investment option.

Uses of Silver

First, let’s understand how and where silver is used. Silver is considered both a precious metal and an industrial metal. Silver is used in jewellery, bullion coins, high-value tableware and utensils. Its compounds are used in x-ray film, photography, catheters and other medical instruments. Silver is also a highly conductive metal. It possesses the characteristics of both electrical and thermal conductivity. It plays a very important part in the manufacturing process of electronics, semiconductors and solar panels on account of its highly conductive properties. Silver containing brazing alloys are used for brazing metallic materials such as cobalt, nickel and copper-based alloys.

The Silver Standard

The silver standard is a monetary system that was used from the Sumerians (3000 BCE) until the year 1893 post which the world moved on to the Gold Standard. By the year 1935, the gold standard was also discontinued in favour of government fiat currencies pegged to the Pound Sterling and US Dollar.

1 Year Silver Prices

All-time Silver Prices

Silver as an Investment Vehicle

Silver can be used as an investment option like other precious and industrial metals. Like gold, silver can be bought in physical form as a bar, as coins, as jewellery and as an exchange-traded fund (ETF). Silver ETFs are a quick and easy way to purchase and store silver without the need for physical storage space. The iShares Silver Trust is the largest silver ETF backed by 340 million ounces in storage.

Like all precious metals, silver can be used as a hedge against inflation, and devaluation of currencies.

Why Silver now?

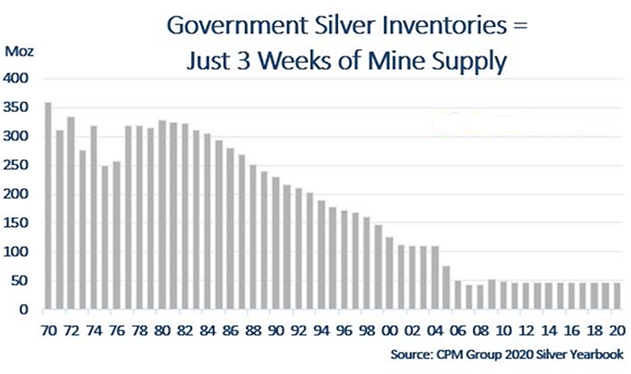

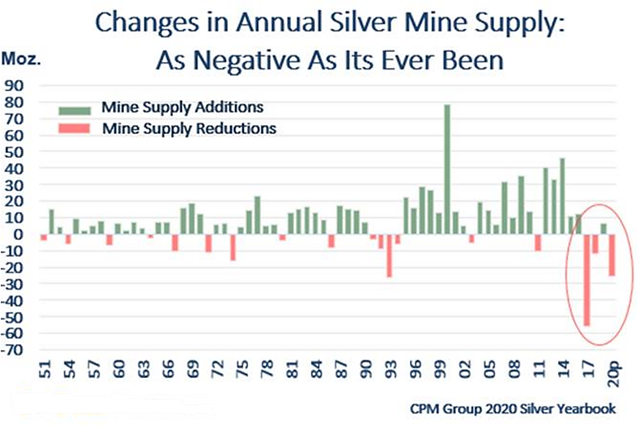

The pandemic has given central banks no choice but to pump liquidity into the system. This has been a huge boon to the stock market with indices hitting their all-time highs. This has caused inflation in the US to shoot up to multi-decade highs. From a fiscal and interest rate point of view, this has left the banks in a tough place in terms of what comes next. Gold and Silver are natural hedges against the currency, financial markets, and inflation. Furthermore, the production of Silver is reducing.

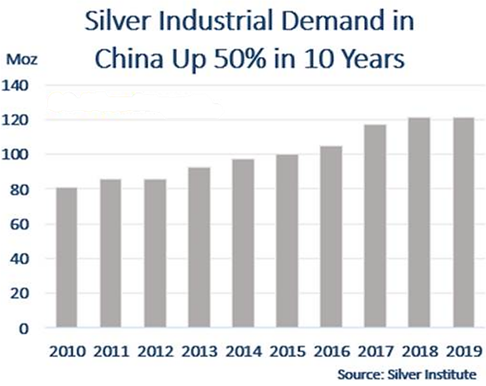

The industrial demand for Silver is growing as the world advances in technology. In electric vehicles, the need for silver in components is twice as much as it’s needed in traditional ICE vehicles.

Silver is a versatile investment option and can play an important part in your portfolio. To know more, contact our advisors and stay tuned for more insights from ithought.