Our Services

VRDDHI PMS

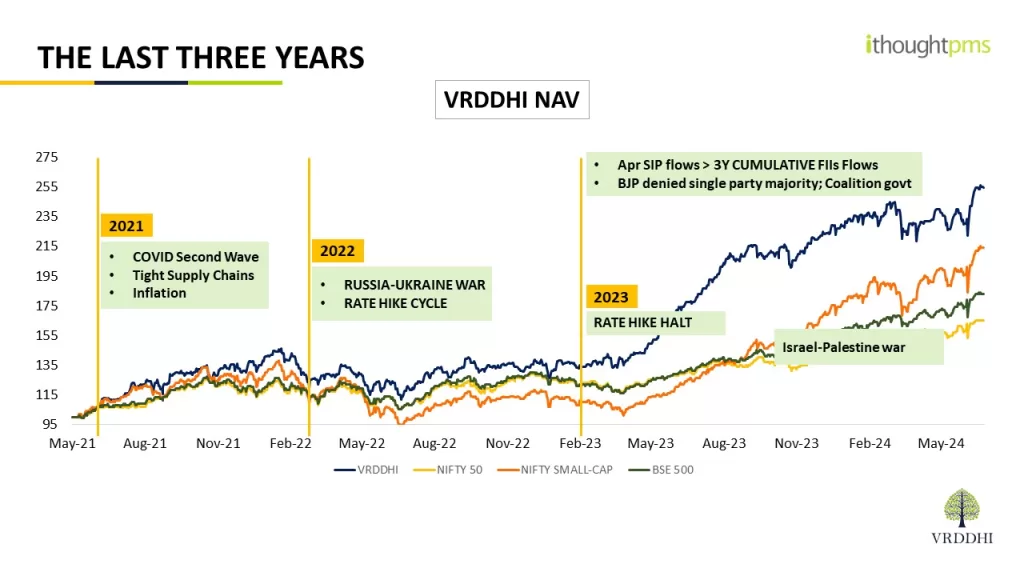

A Small Cap PMS that has displayed market beating returns through superior risk-control characteristics- this is demonstrated by the fact that the PMS has done well in both bull and bear markets, generating above-average absolute returns and also beating its benchmark handsomely over the market cycle.

"I am delighted to share my positive experience with the VRDDHI scheme offered by iThought PMS. Seeking a high-return investment strategy with a growth target of 15%+ per year, I chose VRDDHI, a small and mid-cap aggressive scheme."

"Thanks to the expertise and dedication of the iThought team, VRDDHI has exceeded my expectations, delivering an impressive average return of 30% per year over the last two years."

"In addition to the exceptional returns, VRDDHI's stellar performance earned it a spot among the top 10 PMS performers in India. The request of having a minimum investment horizon of 5 years, without withdrawal of capital, and consistently participating in opportunities shared by iThought have been crucial in realizing these remarkable returns."

"I am extremely grateful to the iThought team for their continued efforts and commitment to maximizing investor returns."

Indirani Kumarakrishnan

Retired Former Director, Oxfam"Over three years now, I have invested in Vrddhi PMS scheme in iThought with Mr. Shyam Sekar & his team and my experience so far has been marvellous. Vrddhi is a small cap equity fund which gives an exclusive opportunity to gain access to the growth potential of budding companies with promising futures."

"Even though the market was unstable, the performance of this fund has always been superior to my expectations. What sets it apart is its meticulous research and stock selection strategies that ensure a diversified and sound portfolio."

"The team behind Vrddhi displays profound knowledge about the small cap sector and they handle their fund proactively. I have been kept well informed by their transparent communication and regular updates thereby giving me confidence in investing in them."

Dr T S Senthil Kumar

Consultant & Lead -Neuro Anesthesiologist, SIMS Hospitals, ChennaiVRDDHI

Small Cap Stocks With High Growth Potential India

In recent years, domestic investors have turned their attention to small cap stocks. There’s a lot of money to be made in this segment and past performance looks promising. The mid, small, and micro cap universe is vast leaving investors with plenty of choice. Up cycles are followed by downturns. Most investors begin their small cap investing journeys when past performance is evident and consistent. Many exit prematurely when performance undershoots expectations.

VRDDHI is committed to making small cap investing profitable for the long-term investor no matter when they begin. We achieve this by being selective with portfolio companies, paying attention to entry valuations, deploying capital in phases, and being thorough in our due diligence. VRDDHI portfolios are resilient – having survived two waves of COVID, an eventful macroeconomic environment, and geopolitical uncertainties globally.

We Apply Our Philosophy at VRDDHI to Back Companies With…

360°Market Leadership Characteristics

Low Debt & Strong Cash Flows

Growth Drivers

Strong Corporate Governance Standards & Capital Allocation Skills

Investment Philosophy – Risk Control

Quality of risk management in a portfolio can only be tested during tough market conditions. In a rising market everybody does well and it is difficult to distinguish a high risk portfolio from the one which has taken low-risks.

However, in a falling market, it is difficult to hide behind returns and a portfolio’s risk-characteristics are exposed. A portfolio with superior risk control mechanisms in place will limit the portfolio fall to much less than the market fall.

Below is VRDDHI’s performance in every down markets since its inception in May 2021.

VRDDHI’s Operating Manual

What is the secret to our success? It’s simple: we go the extra mile.

- Firstly, VRDDHI hunts for winners in undiscovered places that are under owned (minimal participation from institutional investors) and under researched (not covered by equity research houses). By moving away from the crowd and market darlings, VRDDHI finds businesses that are market leaders in their chosen niches.

- Second, we understand that entry level valuations make a world of a difference. In small cap investing, alpha is the reward of patience. Attractive entry valuations offer high margin of safety if things were to go south, which they invariably do every once in a while.

- Third, to ensure the above, we follow bottom-up capital deployment strategy. We will deploy capital only when an investible idea offers enough margin of safety at entry valuation. We do not follow model portfolio approach which disregards entry valuation. We believe as fiduciary of your capital, it is our duty to construct portfolio in every account with utmost care without compromising any of VRDDHI’s investment principles. In the absence of lack of opportunities we are absolutely comfortable sitting on cash that we know can act like dry powder at the opportune time.

- Fourth, VRDDHI follows a counterintuitive approach and gives equal importance to tracking qualitative factors like management capabilities and capital allocation track record as opposed to analysing only traditional financial metrics. These qualitative factors eventually show up in financial metrics. This allows VRDDHI to filter out the red herrings: since qualitative metrics can be more consistent and reliable indicators of future performance.

- Last but not the least, portfolio companies of VRDDHI have strong balance sheets with majority of the companies being cash-rich. By investing in such businesses, we improve the odds in our favor significantly as risk of bankruptcy is practically eliminated.

VRDDHI promises to be an investment solution that focuses on risk control rather than returns to deliver maximum returns per unit of risk taken. Process and discipline have been our guiding lights in this journey. Over the last decade, we have gradually tightened our process learning from our mistakes. We are committed to running this marathon with long-term investors.

VRDDHI Performance - December 2025

TERMS OF INVESTMENT

|

|

|

|---|---|

|

Minimum investment

|

₹ 50,00,000

|

|

Benchmark

|

S&P BSE 500 TRI

|

|

Fees

|

1.5% Fixed Management fee on daily weighted average AUM (+) Variable performance fee of 15% over and above 8% hurdle with no catch up (excluding GST and other expenses).

High Water Mark (HWM) principle applies. HWM compounds. |

|

Exit Terms

|

Exit Load as prescribed by SEBI. First year exit load at 3%; second year 2%, third year – 1%. Performance Fee and other Charges will be calculated on a Pro-rata basis and charged.

|

|

Asset Allocation

|

Equity: 0-100%

Cash/Liquid BeES: 0-100% |

|

Single Stock Exposure

|

Maximum 15% allocation in one idea.

|

Frequently Asked Questions

VRDDHI is meant for someone who has an investment horizon of 5+ years. We invest in a space which is exciting as there is a possibility of finding undiscovered gems. However in this segment stock prices can have huge swings on either sides – the prospective investor should not be plagued by the volatility of the stock price (smallcaps/microcaps/midcaps can correct by 30-40-50% or even more during bear phases). It is important that the prospective investor should align with our investing process and try to understand how we manage and control risks and only then invests with us. We don’t focus on maximizing returns instead we focus only on minimizing risks.

We follow a bottom up method of picking stocks. We read 100s of Annual Reports and attend 100s of AGMs and concalls across the year to generate ideas. Further, we also participate in industry trade shows & exhibitions. Lastly, we run qualitative and quantitative screens to find new ideas.

|

Title

|

Redmi 9A

|

|---|---|

|

Minimum investment

|

₹ 50,00,000

|

|

Benchmark

|

S&P BSE 500 TRI

|

|

Exit Terms

|

NIL

|

|

Fees

|

Fixed fee of 1.5% p.a. of AUM computed on daily average portfolio value charged on a quarterly basis. All other expenses at Actuals. (Fees Excl. GST).

|

|

Exit Terms

|

Exit Load as prescribed by SEBI. First year exit load at 3%; second year 2%, third year – 1%. Performance Fee and other Charges will be calculated on a Pro-rata basis and charged.

|

|

Asset Allocation

|

Equity: 0-100%

Cash/Liquid BeES: 0-100% |

|

Single Stock Exposure

|

Not to exceed 25% of the total NAV of the portfolio.

|

Our entire focus in investing is to manage and control risks. Our belief is that if one is able to protect the downside, then up-side usually takes care of itself. We try to find undiscovered gems – businesses which are market leaders in their niche, are run by honest & capable owners/managers and are available at attractive valuations.

Since these businesses are usually not covered by brokerages and do not have much information available on them – we need to get on the ground to uncover insights – we do this by speaking to people in the value chain of the business – customers, suppliers, distributors, competitors, auditors, bankers, employees, ex-employees etc to understand more about the business, industry, and the people who run the company. This enables us to develop differential insights and sown the business over a long period of time ignoring the market gyrations.

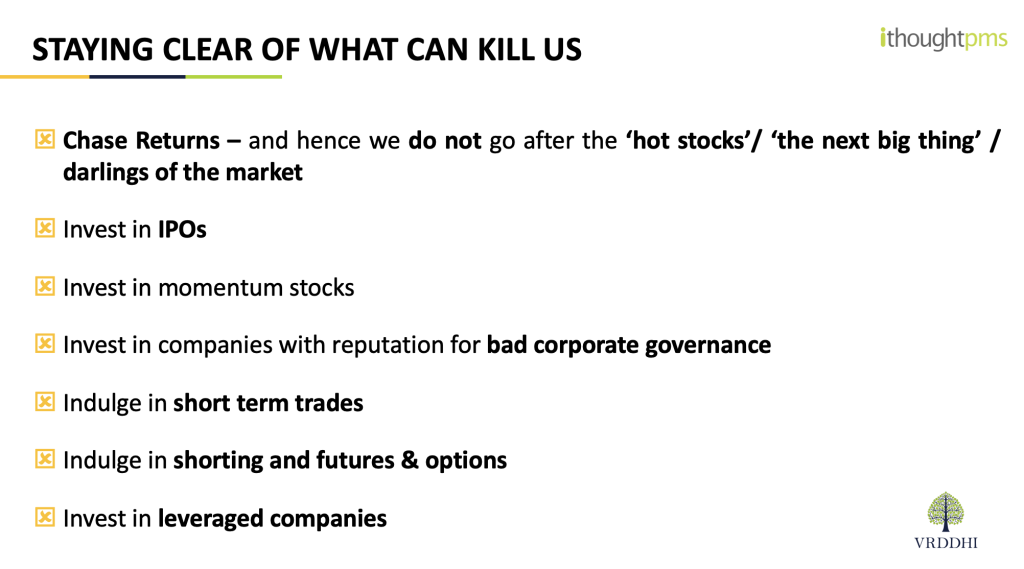

While it is important to understand what we do, it is equally important to state what we don’t do – and that also makes us different.

Timing a market top or bottom is almost impossible. We encourage our prospective investors to have a long term view as the impact of timing significantly reduces over a long term.

Further given we don’t follow a model portfolio approach as a result all the money is not invested on day 1. Our investment is driven by bottom up opportunities that we may find at any given time. During a heated market, our opportunity set reduces and as a result we may not invest the entire amount fully. Thus, when the market corrects, the portfolios may be cushioned due to the cash (un-invested portion). The corollary of this approach is that we may under-perform in newly opened accounts in a rising market as we haven’t invested money and the market continues to rise.

Similarly in a benign market, we may invest more aggressively and deploy the money much faster.

This way of investing has worked for us over market cycles- we believe it makes sense to be patient and rational and not be driven by market levels as long as one has a long term view (5 years+)