Our Services

SAY GOODBYE TO COMPROMISING RETURNS TO MANAGE RISK

Sphere is a time-tested holistic investment solution for the risk and return-conscious investor. We’ve translated our learnings from how market cycles work into a portfolio management service.

Ranu Kayastha Bhogal

I have been a client since 2021. I am very happy with the way my fund has been managed by the ithought team.

I particularly value the transparency as well as the promptness with which the team responds to my requests and occasional doubts.

I would recommend ithoughtpms - SPHERE without a bit of doubt or hesitation. Thank you.

Srikanth Major

After ithought came into our lives, there was less time wasted on YouTube, reading business newspapers for pleasure and not to identify the next big thing, and less overthinking about 2nd or 3rd order effects.

They have outsourced worry and given us peace of mind. Thorough professionals with risk and reward maintain a good balance.

Ajiet Sarin

I was introduced to ithought more than a year back. SPHERE was a relatively new programme that had been launched and was apparently showing promise. The whole concept was well thought out, with a clear purpose, and I jumped on it vis-à-vis the other programs. Clarity, simplicity, and purpose are great drivers at SPHERE.

SPHERE has kept ahead of the stock indices, which is a great achievement.

What I expect from SPHERE is to build some flexibility in the operating system for the client vis-a-vis the programme guidelines. Overall, happy to be part of the journey!

Ashwin Balasubramaniam

Been a Customer of the Sphere and with iThought since 2017. Really pleased with their service and the performance. They tell you what you need to hear and not what you want to hear and deliver steady long term performance. Would recommend them for all your financial planning and investment needs.

SPHERE

360-DEGREE INVESTING PMS – SPHERE A REVOLUTIONARY JOURNEY

We built Sphere using our top 3 lessons from how markets work:

- Even in the worst years, at least one asset performs well.

- 50% of the time all asset classes delivered positive returns.

- There are no bad assets, only bad times to invest.

Investment success is repeatable. All it takes are a few simple things: asset allocation, simple financial products, systematic participation, fair fee structures, and consistent compounding.

Most investors want a place to save consistently for retirement. They would like to see all their investment decisions in one place. This allows them to transparently measure participation and performance. Moreover, investors want to experience stress free investing. Asset allocation and multi asset investing is one way to make all of this happen. Sphere is committed to delivering a stress-free transparent and performance oriented investment experience.

WHAT MAKES SPHERE SPECIAL?

High conviction investing pms

We know that time tested strategies beat back tested models. Sphere was born out of a decade of real results from our RIA practice. This isn’t a back-tested model based on hypothetical situations. Sphere has weathered the market’s many moods to become a proven investment solution.

360-Degree Investing:

What if you had all your investment ideas in one place? It becomes easy to know what you own, measure how you’re doing, and decide where to invest next. Sphere brings together stocks, ETFs, global assets, and more.

All weather investing PMS:

Imagine never having to worry about where to invest or when to invest. At Sphere, we identify interesting ideas, nurture conviction in contrarian themes, and position each theme within your portfolio. This allows you to participate at the right time in the right places.

HOW DOES IT WORK?

INVESTMENT PHILOSOPHY

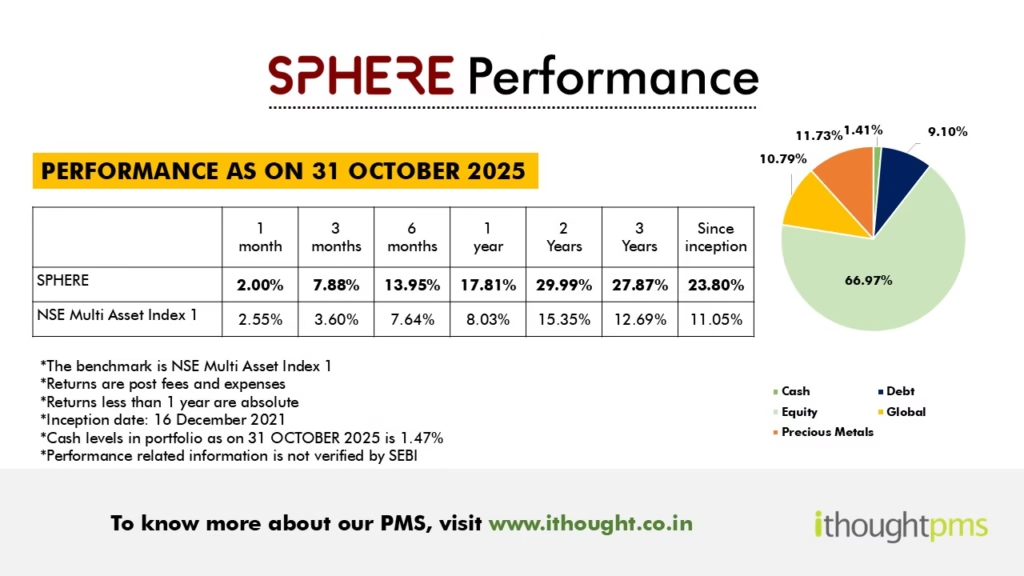

SPHERE Performance - October 2025

TERMS OF INVESTMENTS

|

|

|

|---|---|

|

Minimum investment

|

₹ 50,00,000

|

|

Benchmark

|

NSE Multi-Asset Index 1

|

|

Exit Terms

|

NIL

|

|

Fees

|

Fixed fee of 1.5% p.a. of AUM computed on daily average portfolio value charged on a quarterly basis. All other expenses at Actuals. (Fees Excl. GST).

|

|

Asset Allocation

|

Equity: 0-100% Mutual Funds: 0-100%

ETF: 0-100% Global Funds: 0-100% Gold: 0-100% Cash/Liquid bees/Liquid funds: 0-100% |

|

Single Stock Exposure

|

Not to exceed 25% of the total NAV of the portfolio.

|

Frequently Asked Questions

SPHERE is meant for an investor who wants to take advantage of thematic opportunities. These thematic opportunities may appear in the form of sectors, geographies, or even assets. SPHERE suits the cost conscious and disciplined investor. SPHERE fee structure: Fixed fee of 1.5% p.a. of AUM computed on daily average portfolio value charged on a quarterly basis. All other expenses at Actuals. (Fees Excl. GST). SPHERE is the ideal product to grow your retirement nest egg and is suitable for all investors keen on long-term wealth creation.

SPHERE allows you to have your cake and eat it too. Peter Lynch aptly called diversification as di-worse-ification. At SPHERE, we’ll help you reap the benefits of diverse product offerings without losing focus. SPHERE is an all-in-one investment product suitable for long-term wealth creation.